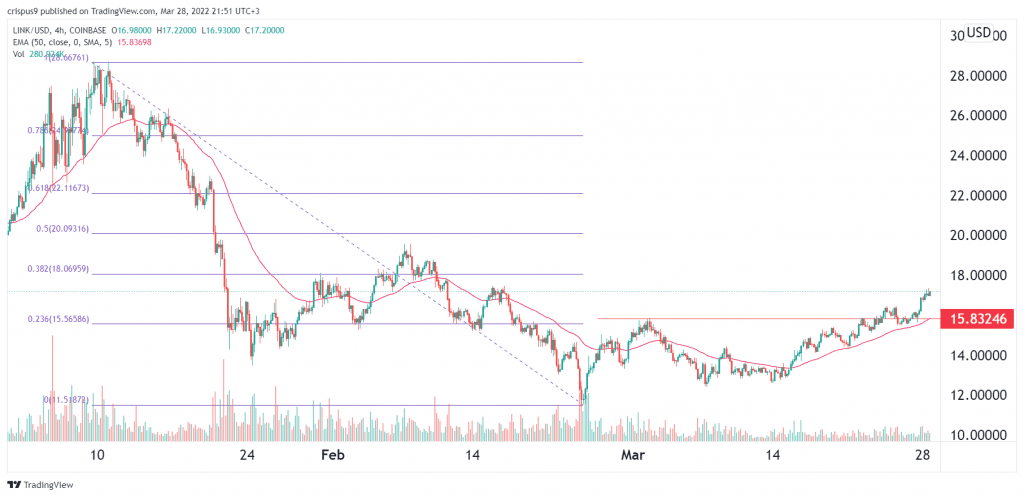

- Chainlink price crossed an important resistance level. This could be a sign that bulls have prevailed and that the price will keep rising.

Chainlink price has held steady recently as part of the overall strength of Bitcoin and other altcoins. The LINK price has risen to about $17.15, which is the highest it has been since February this year. As a result, it has moved up by over 50% from its lowest level this year. Other oracle networks like WINKLink and Maker have also risen.

LINK oracle market share

Chainlink is a blockchain project that solves an important challenge in the industry. It provides oracle services that link off-chain data to on-chain networks. For example, a developer can build a DeFi network and incorporate accurate data on prices. Similarly, a developer of sports betting app can incorporate sport results in the app using these oracles.

The potential for Chainlink is limitless. For example, a developer can add data on students in the on-chain network. It is also possible to incorporate weather and traffic data in applications. Therefore, as the blockchain industry grows, analysts expect that the role of Chainlink will continue growing.

There are two main reasons for this. First, the network has a substantial market share in its industry. According to DeFi Llama, it has a total secured value of over $59 billion. It is followed by Maker, which has a TVS of more than $18 billion. Other platforms in the oracle sector are WINKLink, TWAP, Pyth, and Band. Chainlink dominates almost 60%.

Second, Chainlink’s price will likely keep doing well because of the growth of its ecosystem. In addition, the developers have recently launched important additional services in the blockchain industry. Some of these are Keepers, proof of reserve, and verifiable randomness. Most importantly, the project is backed by Eric Schmidt, the former CEO of Google.

Chainlink price prediction

The LINK price has bounced back in the past few weeks. As a result, the coin moved above the important resistance at $15.8, which was the highest point on March 2. In addition, it has moved above the short and long-term volume-weighted moving averages while the volume has held steady. It is also approaching the 38.2% Fibonacci retracement level. Therefore, the next key target to watch will be at the 50% level at $20.