The Carnival share price is back under bearish pressure this Thursday, as it struggles to build on Wednesday’s recovery, which was triggered by news from Pfizer regarding the efficacy of its booster dose on the Omicron COVID-19 variant.

The Carnival share price has declined 31% since October due to a surge in coronavirus cases. Other cruise companies have been similarly affected. As a result, the Bank of America sees price weakness for cruise companies in the second half of 2022, with minor cuts expected. However, the bank maintains its neutral rating on the stock heading into the end of 2021.

The Carnival share price has opened slightly lower on the day, trading at -2.41% lower as of writing.

Carnival Share Price Outlook

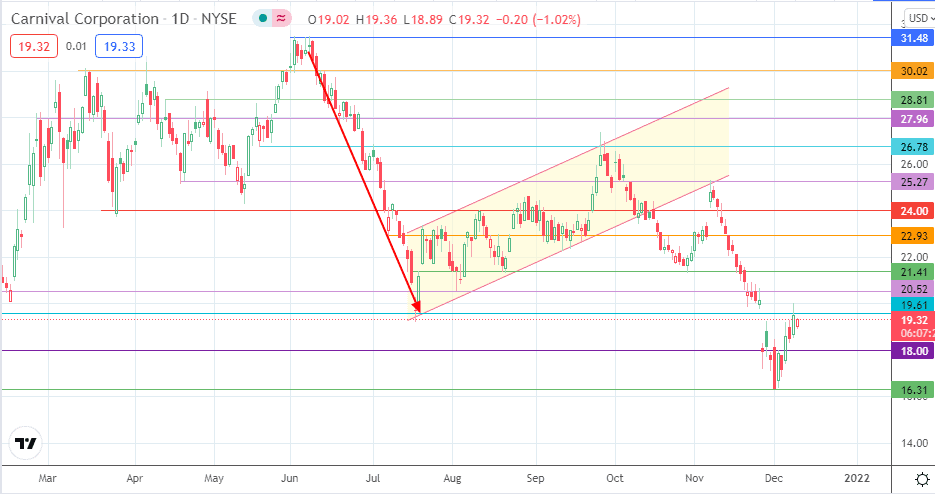

The completed move from the bearish flag’s breakdown on 15 October ended on 1 December, followed by a brief uptick towards the 8 December high.

Following Wednesday’s rejection at the 19.61 resistance, the price bar opened with a bearish gap. If the gap is closed, the price action would still need to take out the 19.61 resistance for 20.52 and 21.41 to come into the picture as immediate upside targets. 22.93 and 24.00 are also targets of note to the north if the price recovery continues.

Otherwise, the outlook changes if the bears seize on the rejection and bearish gap to initiate a “gap-and-go” move to the south, targeting 18.00 as the immediate downside target. The 16.31 support (1 December low) becomes the next port of call if price deterioration occurs below 18.00.

Carnival Corp: Daily Chart

Follow Eno on Twitter.