- The Carnival share price is experiencing the third day of selloffs in response to its dismal 3rd quarter 2021 results.

The decline in the Carnival share price entered its third day this Thursday, as the stock declined by 2.16% as at 1540 hours UTC. This decline follows a 0.8% and 2.48% drop on Tuesday and Wednesday, following the declaration of steep losses by the company.

Carnival Corp suffered a $2.8 billion loss in the 3rd quarter of 2021 after concerns over the delta variant of the coronavirus hurt sales. Carnival Corp was one of the hardest-hit companies as far as the COVID-19 pandemic is concerned. In addition to having several of its cruises quarantined early in the pandemic with sick passengers, the shutdown in global travel and country-specific restrictions grounded most of its fleet, leading to a loss of revenue.

The company expects to exceed 2019 booking levels in 2022, as several of its cruiseliners are being brought back to service.

Carnival Share Price Outlook

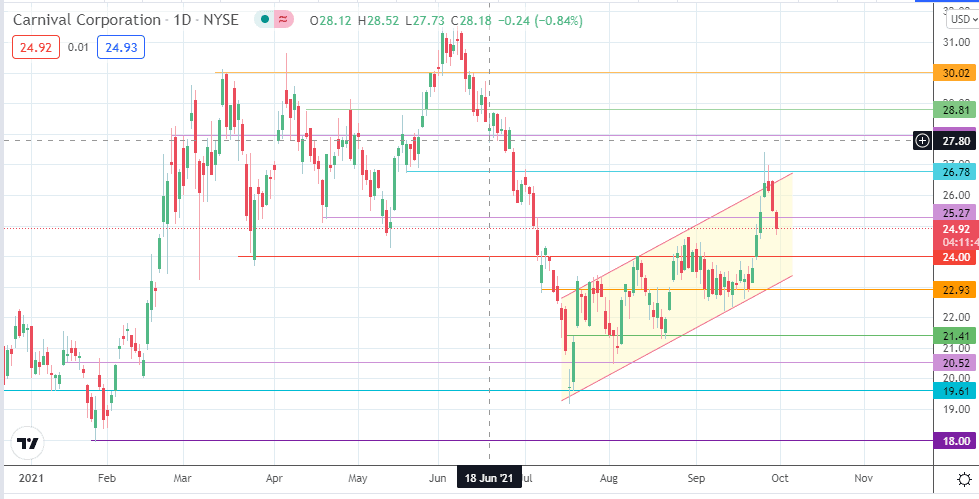

Following the formation of two pinbars at the channel’s return line and the rejection at 26.78, the Carnival share price now challenges the support at 25.27. A breakdown of this level allows for a retreat towards 24.00. Below this level, 22.93 lines up as the critical support in maintaining the overall bullish recovery.

If this support fails, the channel’s trend line also gives way, and 21.41 becomes a viable downside target. This move would also mark the resumption of the downtrend, completing the potential bearish flag formation.

On the other hand, if the bulls can push the price above the 26.78 resistance, 27.96 (2 March/21 May highs and cluster of lows on 18-23 June) becomes the next upside target. A continuation of this advance brings 28.81 (14 April high) and 30.02 into the picture as additional upside targets.

Carnival Price Chart (Daily)

Follow Eno on Twitter.