- This article helps readers understand the Cardano cryptocurrency and includes Cardano Price Predictions for 2022, 2025, and 2030.

This article helps readers understand the Cardano cryptocurrency and provides Cardano Price Predictions for 2022, 2025, and 2030.

Cardano is a layer-1 blockchain for smart contracts, similar to Ethereum. Cardano’s market cap grew from $5 billion to approximately $43 billion in 2021. Many analysts have been updating their Cardano price predictions since the Alonzo upgrade went live on the Cardano blockchain. This upgrade enabled the smart contract functionality on Cardano.

Cardano TVL Is Soaring

The DeFI TVL tracking site, DeFi Llama, reveals that the Total Locked Value (TVL) on the Cardano blockchain has constantly been increasing since the start of 2023. During this time, the TVL has surged by more than 200%. Nevertheless, the current TVL of $162 million is still 50% down from its all-time high.

Cardano’s Founder

The Cardano project was founded by Charles Hoskinson, a co-founder of Ethereum, and is developed by the IOHK (Input Output Hong Kong) research and development company.

Charles Hoskinson is a mathematician, entrepreneur, and cryptocurrency expert who has been involved in the development of blockchain technology and cryptocurrency since 2011. In 2013, he co-founded Ethereum with Vitalik Buterin and served as the Chief Executive Officer (CEO) of the Ethereum Foundation until 2014. After leaving Ethereum, he founded IOHK, a blockchain research and development company that focuses on building scalable, secure, and decentralized systems.

IOHK is a research and development company that was founded in 2015 by Charles Hoskinson and Jeremy Wood. The company is focused on building decentralized systems, including blockchains, smart contracts, and other distributed ledger technologies, to solve real-world problems. IOHK is the primary development team behind Cardano, and has a team of over 100 researchers, developers, and engineers working on the project.

Project Road Map

The Alonzo upgrade in September 2021 started phase three of Cardano’s five-step road map. The scheduled upgrades, named after famed mathematicians, will mark essential milestones in Cardano’s development.

Byron improved network security and launched the official wallet for the ADA token. Next came ‘Shelley‘, which, according to the roadmap, would make Cardano “50-100 times more decentralized than other large blockchain networks”.

The current phase Goguen, enabled smart-contract functionality, allowing Cardano to compete for lucrative decentralized finance (DeFi) projects. Basho, which aims to increase scalability is next, followed by Voltaire, which will focus on governance and self-sustainability.

Cardano’s Long-term Prospects

Cardano is well-placed to capitalize from the growth of Decentralized Finance. However, the nascent sector is young and fiercely contested. Recently, rival blockchains like Solana and Avalanche have emerged as serious contenders.

The key to Cardano’s success relies on its road map. If the Basho upgrade delivers, Cardano’s improved scalability could give it an edge over newer projects, which may slow down as they undergo hard forks and upgrades. In that event, Cardano should attract institutional investors, providing a considerable tailwind for the ADA token price.

[crypto name=”cardano”]

Cardano Price Forecast 2023

The ADA price chart shows that the price surged by 88% in 2023. However, the price failed to gain any strength above the key resistance level of $0.40 and had another pullback. Currently, the price is still trading above the 200-day moving average, which puts another retest of the $0.40 level on the cards.

Cardano price prediction 2023 will flip very bullish if the price reclaims the $0.40 level. In this scenario, bulls may target the $0.69 level, which will be the next major resistance on a higher timeframe.

Furthermore, Cardano’s adoption by developers has been below par compared to other large-cap peers. Despite claims by the company that thousands of developers are building in the ecosystem, its DeFi ecosystem has a total value locked of only $63 million, making it the 31st biggest player in the industry. Many of its DeFi apps have a total value locked of less than $1 million.

Additionally, Cardano has a small market share in industries such as gaming and the metaverse compared to Ethereum, which has maintained a strong market share in these industries. This lack of adoption and market share has likely contributed to the decline of Cardano’s price.

Another factor contributing to Cardano’s underperformance in the markets is the lack of widespread adoption of its technology. Despite the introduction of smart contract features through the Alonzo hard fork in October 2021, Cardano has continued to receive a mild reception from developers and has not gained as much traction as other DeFi protocols like Uniswap, Curve, and Maker. Additionally, its NFT ecosystem has been relatively smaller than that of other chains like Flow, Immutable X, and Ethereum.

Furthermore, the lack of clarity on regulatory matters and the prevalence of scams and Ponzi schemes in the cryptocurrency industry have also likely had a negative impact on Cardano’s performance. The uncertainty surrounding regulation has weighed on growth and innovation within the sector, and investor sentiment has likely been negatively affected by these events.

Overall, in the next few trading sessions, I expect Cardano’s value to drop below the $0.20 price level. For the long-term, there is a high likelihood we might see it falling to trade near or below the $0.10 price level. This analysis, however, will be invalidated by the crypto trading above the $0.30 price level.

Cardano Daily Chart

Cardano Price Predictions for 2025 and 2030

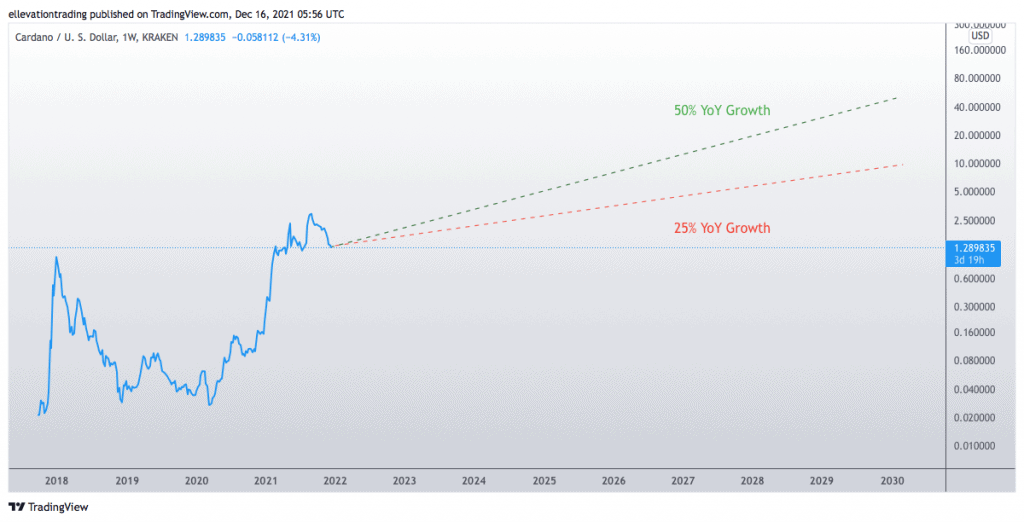

The cryptocurrency market is still evolving and may look very different in the coming years. Therefore, long-term price forecasts should be taken with a pinch of salt. Furthermore, the years ahead are unlikely to replicate the gains made in 2021. Nonetheless, even moderate growth could deliver attractive returns.

The below chart highlights two modest growth forecasts of 25% and 50% (year-over-year). The model suggests a reasonable 12-month price target is $1.63-$1.95. Moving forward to 2025, it forecasts a Cardano price between $2.60-$4.39 and as high as $9.69-$49.98 in 2030.

Unfortunately, based on what we have seen throughout the year, there is another scenario where Cardano continues with the current bearish trend that has seen its value drop by 77 per cent year-to-date. In this scenario, Cardano’s price will have dropped to levels below $0.01 by 2025. It is important to note that, based on what has happened over the past year, there is a high chance that projects such as Cardano may fail to recover to their 2021 price high by 2025. Therefore, caution needs to be taken when investing for the long term.

Summary

If Cardano achieves widespread adoption, the price could easily exceed the above projections. Furthermore, considering Ethereum is valued at $500 billion, Cardano’s long-term prospects are good.

Following the recent industry-wide cryptocurrency recovery, it is also highly likely that we might continue to see Cardano’s price surging for the next few months as a result of its significant correlation with the industry.

However, there is no guarantee that Cardano topples Ethereum. And like all cryptocurrencies, investing in Cardano is risky. Nonetheless, if the industry continues to grow and Cardano remains a major player, the rewards could outweigh the risks.

Follow us on Twitter