The Bank of Canada (BoC) is expected to leave the interest rate unchanged at 1.75% later today, according to 22 out of 23 analysts that were polled by Bloomberg. Greater focus will therefore be on the statements by BoC Chief Stephen Poloz.

The Canadian Dollar has been on a stellar run of appreciation in 2019, appreciating by more than 3% vs. the US Dollar. It has also gained ground on the struggling British Pound.

Is it time for the CAD to take a breather, or will it find strength from the BoC to keep marching on?

This is why today’s rate statement by Poloz will be a thing to look out for. Poloz is expected to comment on the state of the Canadian economy, making reference to inflationary trends and how the global economic outlook will affect the Canadian economy via its impact on crude oil prices.

Some analysts feel that the Canadian economy is in a good place and therefore there are no reasons for Poloz to comment on interest rates. However, there has been a lot of talks about reducing rates south of the border, and with Canada being the biggest trading partner of the US, it is likely that the economic slowdown of the USA might influence Poloz.

Possible Trade Ideas

The ideal situation will be for Poloz to stay away from making any comments about interest rates. If an acknowledgement of the healthy status of the Canadian economy is made, as well as noting any ongoing or future downside risks for the economy, this will make a good case for more bullishness on the CAD, especially against the British Pound which is finding it very hard to shake off the Brexit cobwebs. With US Fed Reserve Chairman Powell’s speech starting at the same time that Poloz will be making his statement, it is best to trade this news item with the GBPCAD.

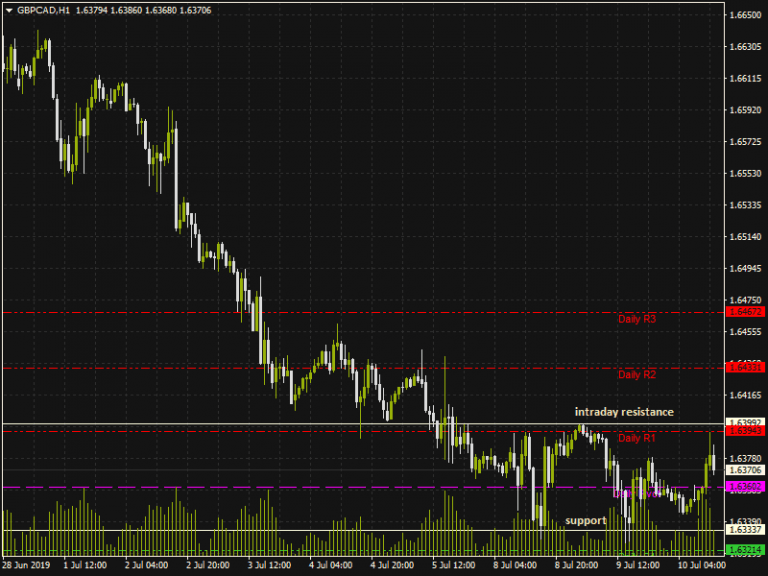

The GBPCAD continues to remain in a long term downtrend, despite being range-bound on the hourly chart. Price is currently at the top end of the intraday range (1.63943), which is also where the R1 pivot level is situated. Positive highlights about the Canadian economy should make for a good sell trade on the GBPCAD, especially of the prices breaks resistance and stalls at the Daily R2 at 1.6433, or R3 at 1.6467. However, if the prices trades above 1.6475, which is a level just above the Daily R3 the bearish bias would be abandoned. If the price indeed turns lower I suspect traders will target some of the support levels seen at 1.6321 and even possible 1.6194 over the course of several days.

GBPCAD Chart

Don’t miss a beat! Follow us on Twitter.

Download our Q3 market outlook today for our longer-term outlook for the markets and trade ideas.