- The CAC 40 index is struggling as the outlook of the French economy dims. What next as the EUR/CHF and EUR/USD reach parity?

The CAC 40 index is languishing as the outlook of the French economy dims. The index, which is made of France’s blue-chip companies, is trading at €5,912, which is about 20% below the highest point this year. This performance is in line with other top European indices like German DAX, Italian FTSE MIB, euro Stoxx 50, and Spain’s IBEX 35.

EUR/USD and EUR/CHF reach parity

The CAC 40 index has been struggling in the past few months as investors remain pessimistic about the French economy. Many companies in the country are suffering, which has helped push business confidence to a multi-year low.

One reason for this is that inflation has continued soaring because of the rising energy prices. Now, the crash of the euro will likely make the situation worse. The EUR/USD crashed to the lowest point in more than 20 years and is now a few pips above parity. Similarly, the EUR/CHF price recently dropped below the parity level.

There are implications to the weak euro. For example, since France is a net energy importer, it means that the country’s inflation will worse in the near term. Further, the weak currency will hurt many companies that depend on foreign parts.

The top performers in the CAC index are Hermes International, L’Oreal, Eurofins Scientific, Dassault Systemes, and Louis Vuitton. Luxury brands like Hermes and Louis Vuitton have come under pressure as China’s economy slows. On the other hand, the worst performers in the CAC 40 index were companies like TotalEnergues, Engie, Orange, BNP Paribas, and Societe Generale.

CAC 40 index forecast

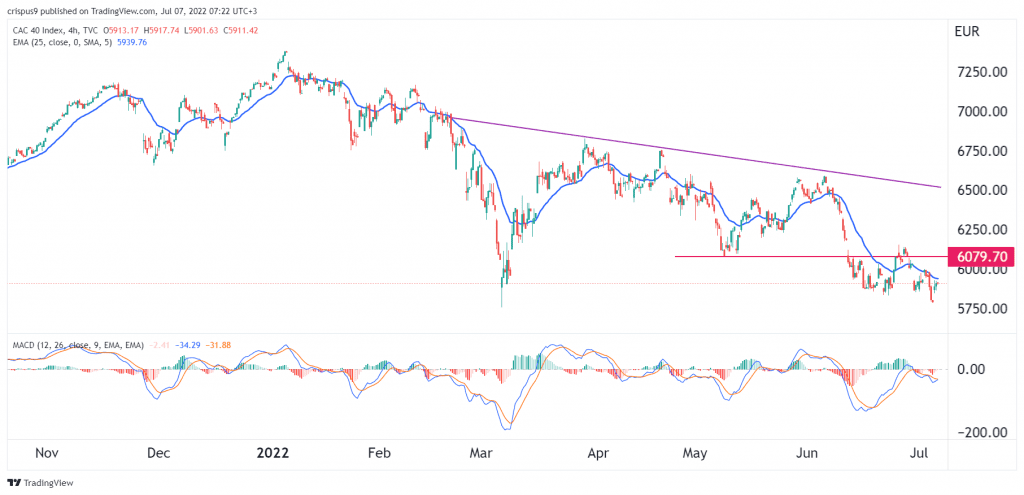

The four-hour chart shows that the CAC index has been in a downward trend. This trend culminated in it falling below the important support at €6,080, which was the lowest point on May 10th. Notably, it then retested this level. A break and retest is usually a continuation sign.

It has moved below the 25-period and 50-period moving averages. Therefore, the CAC 40 index will likely continue falling as bears target the key support at €5,500 in the near term. The stop-loss for this trade will be at €6,000.