- The Burberry share price has crawled back in the past few days as investors wait for the company’s annual results.

The Burberry share price has crawled back in the past few days as investors wait for the company’s annual results. It has risen in the past four straight days and is trading at 1,576p. The BRBY shares have fallen by more than 15% year-to-date and by more than 30% from its highest level in 2021. As a result, the company’s market cap has dropped to about 6.25 billion pounds.

Burberry earnings preview

Burberry and other luxury goods companies are not having a good year even as global travelling resumes. A closer look at most luxury stocks shows that they have all plummeted. For example, the LVMH share price has dropped by more than 35% from its highest point in 2021. As a result, the net worth of Bernard Arnault has dropped by over $53 billion this year. The other luxury stocks that have declined are Kering and Hermes.

Burberry share price has also declined because of the ongoing lockdowns in China, a country where it is seeing robust growth. Therefore, investors will be watching the company’s FY earnings scheduled for Wednesday this week. According to Reuters, analysts expect that the firm’s revenue jumped by 20% on a year-on-year basis to 2.82 billion pounds. In addition, the closely watched same-store sales are expected to have grown by 18.7%.

The results will be important because they will provide the new CEO, Jonathan Akeroyd, an opportunity to show his strategy for the firm. Also, the CEO is expected to talk about his decision to temporarily shut down stores in Russia because of the invasion of Ukraine. But, most importantly, he will talk more about the company’s China business.

Another notable thing about Burberry is that its small size and the fact that its stock has dropped could make it an acquisition target. Besides, many Western companies have been snapping many UK companies in the past few months. They believe that these companies have become extremely cheap because of the Brexit crisis.

Burberry share price forecast

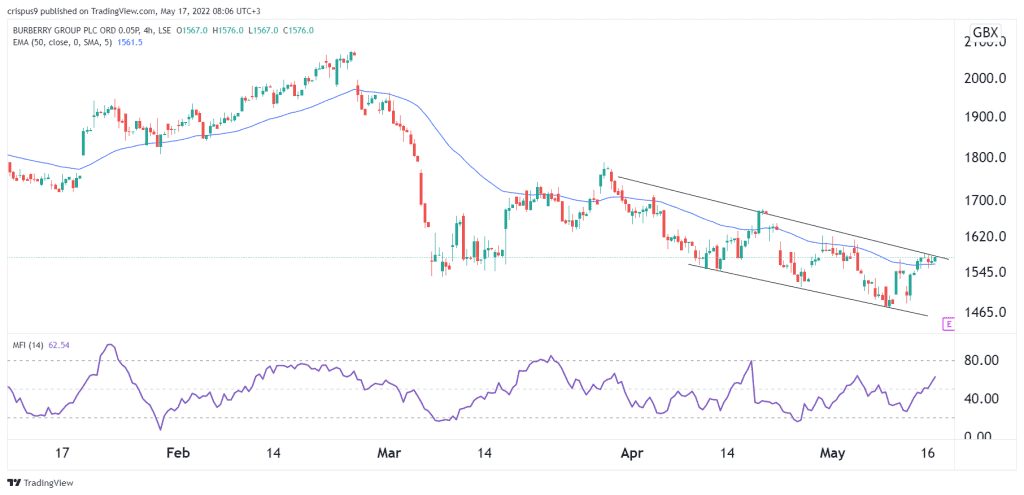

Turning to the four-hour chart, we see that the BRBY share price has been attempting to make a comeback. As a result, the stock has formed a descending channel that is shown in black. It has also managed to move slightly above the 25-day moving average, while the money flow index (MFI) has moved above the neutral point.

Therefore, there is a likelihood that the stock will keep rising as bulls target the key resistance at 1,620p. A break above that level will lead to more gains. The alternative scenario is where the Burberry share price plummets and hits the lower side of the descending channel at 1,465p.