- The BT share price has retreated slightly in the past few days as investors wait for the CMA review on the sports streaming deal.

The BT share price has retreated slightly in the past few days as investors wait for the CMA review on the sports streaming deal. The shares have also declined as investors worry about the company’s wholesale customer loss and potential margin pressure. The stock is trading at 180.40p, which is about 6.62% below the highest level last week.

BT Group investigations

BT Group has been in the spotlight in the past few weeks. First, the Boris Johnson administration is conducting a review on the company’s biggest shareholder, Patrick Drahi. The concern is that Drahi could launch an acquisition bid for the company. This could mean that one of the most important UK companies will move to French ownership.

BT is a vital company that provides fibre and other communication services in the country. However, Drahi has insisted that he is not interested in buying the company or exercising creeping control of the firm. This is notable since many investors have recently bought the company hoping that Drahi could either acquire it or push for a sale.

The BT share price is also reacting to the new CMA investigation on the new joint venture between the firm and Warner Bros. Discovery. The deal will see BT Sport and Eurosport UK be brought together in a 50:50 format. The two firms will then directly contribute, sub-license and deliver benefits of their sports rights to the new JV. As part of the deal, BT will receive 93 million pounds and up to 540 million pounds from the JV. The CMA is investigating whether the deal is lawful.

Meanwhile, analysts at Deutsche Bank are a bit critical of BT share price. They wrote: “Our chief concern is around alt-net fibre build (doubled in 2021 vs 2020 and likely to do so again in 2022), and whilst the recent impact has been modest, the loss of wholesale customers will likely increase with a potential knock-on impact on Consumer and Enterprise.”

BT share price forecast

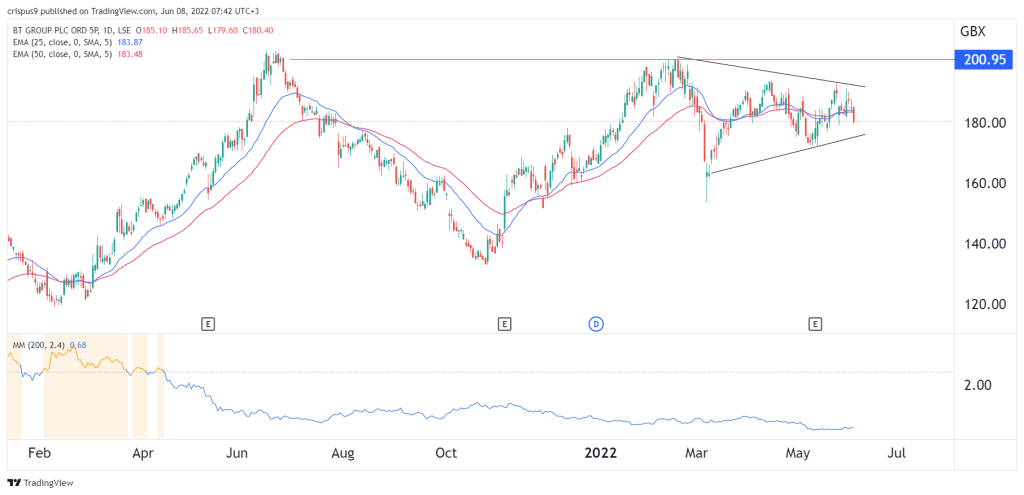

The daily chart shows that the BT share price has been moving under pressure in the past few days amid two probes in the UK. The stock has managed to move below the 25-day and 50-day moving averages. A closer look shows that it has moved slightly below the 25-day and 50-day moving averages. Meanwhile, the Mayer Multiple has moved to 0.68.

The stock has also formed a symmetrical triangle pattern that is shown in black. Therefore, the stock will likely remain in this range in the coming weeks. It will remain between the range of 175p and 190p as investors wait for the probes’ outcome.