- What is the outlook of the BT share price in April 2022? We assess whether the stock is a good buy or not and what to expect.

The BT share price has done well after it bottomed earlier this month. The stock has risen from a monthly low of 154p to a high of 191p. This performance has mirrored the FTSE 100, which has risen from 6,755 to 7,578. It remains slightly below its year-to-date high of 201p. This report will look at the reasons for this performance, BT’s fair value, and the next key levels to watch.

BT has been under the radar for a while, in March, as the company has avoided making any major announcements. This week, the firm announced that it had selected Google as its cloud computing company of choice. It hopes to accelerate its transition to a hybrid computing framework where its data is stored locally and in the cloud.

Notably, BT did not unveil its deal for its sporting division. A few months ago, there was speculation that it will sell the company to DAZN for about $800 million. We then heard that it had ditched talks with the firm and started fresh ones with Discovery. Discovery is a giant American media company merging with AT&T’s Warner Media. So, there is a likelihood that a deal will come out in April.

BT is also expected to have a silent April since no event is scheduled in its calendar. Its most important upcoming event will be the release of its Q4’22 results on May 12th this year. Using traditional metrics, the BT share price appears fairly valued, considering that its dividend yield is expected to rise to 2.54%. It has a PE multiple of about 17, which is in line with its peers.

BT share price forecast

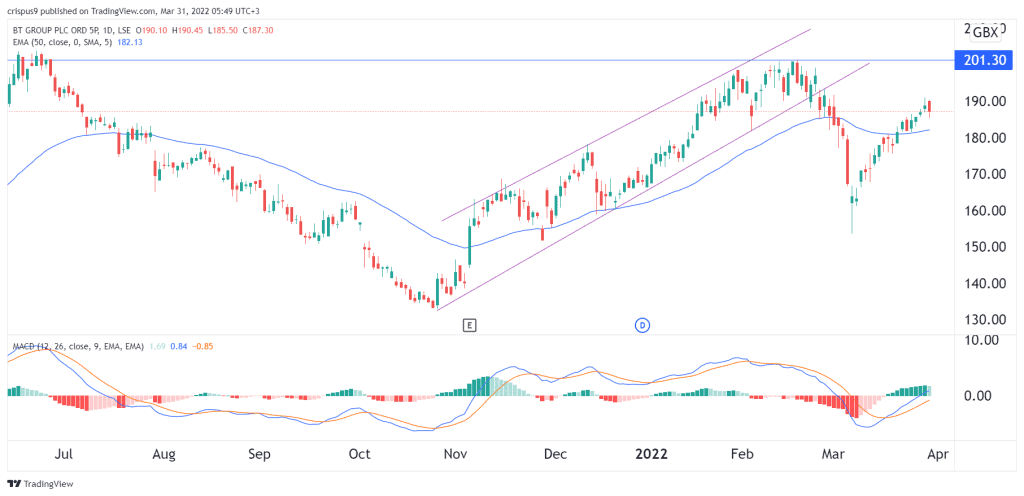

The BT stock price started a major bull run in October 2021 after it crashed to 132p. This recovery pushed it to a high of 201p in February this year, and then the shares started crashing. As it did that, it moved below the lower line of the ascending channel shown in purple.

However, it has now managed to move back above the 50-day MA while the MACD is attempting to rise above the neutral line. Therefore, the outlook for the BT stock in April is bullish, with the next key level to watch being at the YTD high of 201p. A drop below the support at 180p will rule out the bullish view.