- GBPUSD is trading 1.12% higher at 1.2342 making fresh daily highs after Johnson and Varadkar joint statement spread optimist around the

GBPUSD is trading 1.12% higher at 1.2342 making fresh daily highs after Johnson and Varadkar joint statement spread optimist around the markets as they agreed to continue their discussions. Tomorrow Taoiseach will consult with the EU Task Force and the UK Brexit Secretary will meet Michel Barnier tomorrow. GBPUSD adds almost 110 pips on the news.

On the macro news front, the number of Americans filing applications for unemployment benefits unexpectedly fell last week, the Initial Jobless Claims came in at 210K, below expectations of 219K in October 4. The US CPI monthly figure came in at 0.0%, which was lower than the 0.1% that analysts had forecasted. Furthermore, the US Core CPI figure came in at 0.1%, a tad lower than the market consensus figure of 0.2%.

Download our GBPUSD Q4 Outlook Today!

[vc_single_image image=”14654″ img_size=”medium” alignment=”center” style=”vc_box_rounded” onclick=”custom_link” img_link_target=”_blank” link=”https://www.investingcube.com/q4-global-market-outlook-eurusd-gold-crude-oil-bitcoin-sp-500/”]GBPUSD Technical Analysis

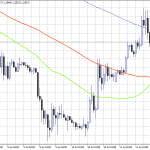

The outlook is positive for GBPUSD as it breached the 50-day moving average and now with the boost by the positive headlines targets the 100-day moving average. Currently, immediate resistance can be found at the daily high of 1.2386, with more offers probably emerging at the 1.2410, the 100-day moving average. On the downside, the first support level for GBPUSD stands at 1.2259 the 50-day moving average and then at 1.2201 the daily low. Going forward, I expect the Brexit developments to guide the movement of GBPUSD.