- Brent crude oil price predictions remain bullish as supply concerns override demand-side headwinds from China.

Crude oil prices on the Brent crude benchmark are trading higher today as supply concerns continue to fuel bullish Brent crude oil price predictions. Brent crude is up 1.11% as of writing as the war in Ukraine grinds towards the end of the 4th month.

Russia is facing a European crude oil import ban, and a drop in production from Libyan oil fields has worsened supply concerns. Libyan Oil Minister Mohamed Aoun says that oil production in the country has nosedived 92% in the last year.

Also fuelling bullish Brent crude oil price predictions is the struggle by some prominent members of the OPEC cartel to meet production targets. These supply concerns are overriding demand-side headwinds from China, where a new COVID outbreak traced to a Beijing bar is prompting renewed lockdown fears.

China is maintaining a zero-COVID policy where the discovery of a handful of cases is met with restrictions. With the Federal Reserve set to make its interest rate decision known on Wednesday, there are indications that commodity prices may experience shockwaves from that event. In addition, geopolitics and China’s COVID situation are expected to have a longer-lasting impact on energy prices.

There are also calls from domestic circles in the United States for the government there to release some crude from its strategic reserves to bring down record-high prices at the gas pumps. With the Brent crude oil variant now trading at key resistance, the Brent crude oil price prediction is heading into the weekend.

Brent Crude Oil Price Prediction

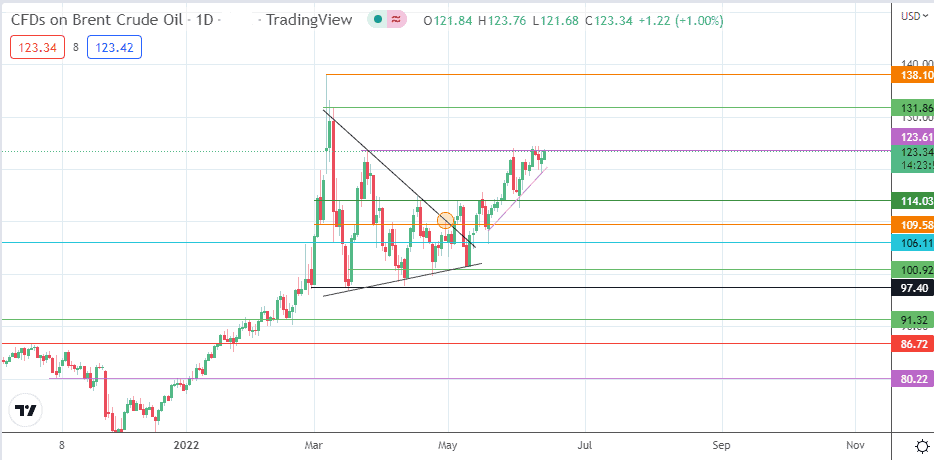

The breakout move from the symmetrical triangle is yet to attain completion. This is because the price move to the north has stalled at the 123.61 resistance. This barrier must be uncapped for the move to continue toward the 131.86 resistance (9 March high). Above this level, a new target to the north is seen at 138.10, the site of the high seen on 7 March 2022. The attainment of this price point completes the triangle’s measured move.

On the flip side, rejection at 123.61 followed by a pullback will target the 114.03 support (23 March low). This move is consequent upon a breakdown of the trendline that connects the lows of 20 May to 13 June 2022. Therefore, an extension of the correction will require a breakdown of 114.03, targeting the 5 May low at 109.58. The 19 May low at 106.11 is the next downside target, followed by the 100.92 psychological price mark.

Brent Crude: Daily Chart