- The BP share price is soaring for a third day running as new demand creeps in on expectations of higher energy prices.

The BP share price has surged strongly this Tuesday, gaining 2.14% on the day as rising crude oil prices pull up the stocks of oil companies. The BP share price is up for a third consecutive day, which is in tandem with the price moves of the Brent crude international benchmark that has also shown three straight days of gains.

Last week, the BP share price got a boost as the company reported its highest quarterly profit in 14 years. Q2 profits of $8.45 billion represented a 200% spike beyond the same quarter’s profit performance in 2021. The BP share price is now up more than 40% in the last year.

The company is set to offload some of its assets as part of its strategic repositioning process. It has agreed to sell its Toledo Refinery 50% stake for $300m to Cenovus Energy Inc. Cenovus had merged with Husky Energy (the original joint venture partner with BP in the refinery) in 2021 and will pay cash for the acquisition. This is BP’s second sale to Cenovus, the first being the offloading of another 50% stake in the Sunrise oil sands project in Alberta, Canada.

The BP Bunch Bioenergia project, the Brazilian sugar and ethanol business that BP owns with Bunge Energy, is also up for sale. At a value of $1.96 billion, the sale is to be handled by JP Morgan, according to the Valor Economico newspaper.

BP Share Price Forecast

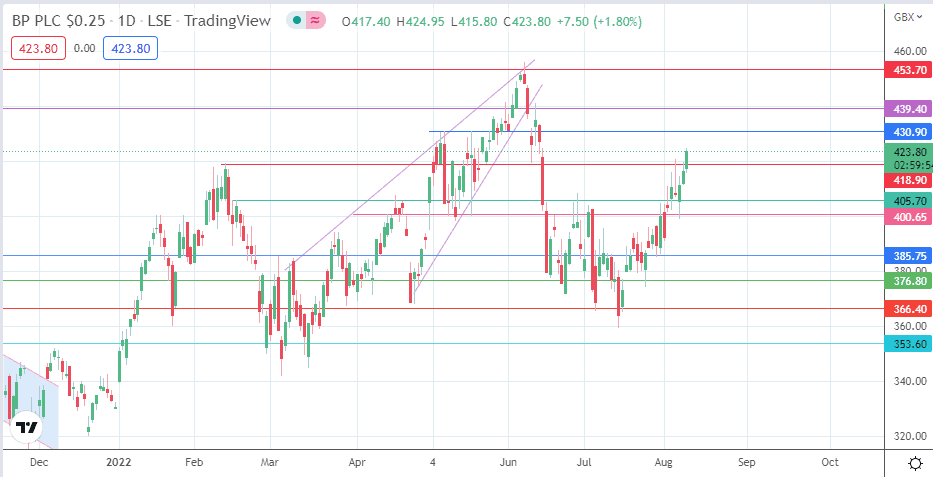

The intraday surge has violated the 418.90 resistance level (11 February high and 24 May low), and a closing penetration that maintains the current candle peak (or higher) confirms the break of this level. 430.90 will be the next upside target awaiting the bulls, formed by previous highs of 6/18/25 May 2022. Clearance of this level opens the door toward the 439.40 price mark (14 June high) before the 453.70 price mark forms an additional barrier to the north.

On the flip side, the bears would be seeking a breakdown of the 405.70 support and the 400.65 psychological price mark (18 May and 5 August lows). This would grant them access to the 385.75 price mark, the site of the previous lows of 11 April and 28 July 2022. Additional support targets are found at 376.80 and 366.40 (6 July low).

BP: Daily Chart