- BP share price has moved staggered in the past few days as investors focus on the wavering prices of oil and natural gas.

BP share price has moved staggered in the past few days as investors focus on the wavering prices of oil and natural gas. The stock is trading at 386p, about 15% below the highest level in June. Other oil supermajors like Shell, Occidental, and Chevron have also pulled back from their highs.

Oil and gas retreat

BP stock price has struggled recently because of the rising recession risks that have pushed the price of oil and gas sharply lower. Earlier this week, the price of Brent and West Texas Intermediate (WTI) dropped below the important support at $100. They have since bounced back and are trading at $104 and $102, respectively.

In addition to oil price movements, there have been other important developments in the oil market. For example, Shell decided to revise the value of its oil and gas assets on Thursday. The company, assuming an average price of $80, raised its assets by $4.5 billion.

Therefore, it means that the firm’s total value of production and exploration assets stands at almost $130 billion. Therefore, analysts believe that BP will also do the same considering that oil and gas prices have surged in the past few months.

Still, analysts believe that BP is a good stock to buy even as oil prices waver. It is expected to have record profits this year as volume of oil demand rises. The firm is also buying back shares worth billions of dollars.

By so doing, it is reducing the number of outstanding shares, which will boost its earnings per share. The firm repurchased stock worth $1.6 billion in Q1 and then expanded its repurchases by $2.5 billion.

BP share price forecast

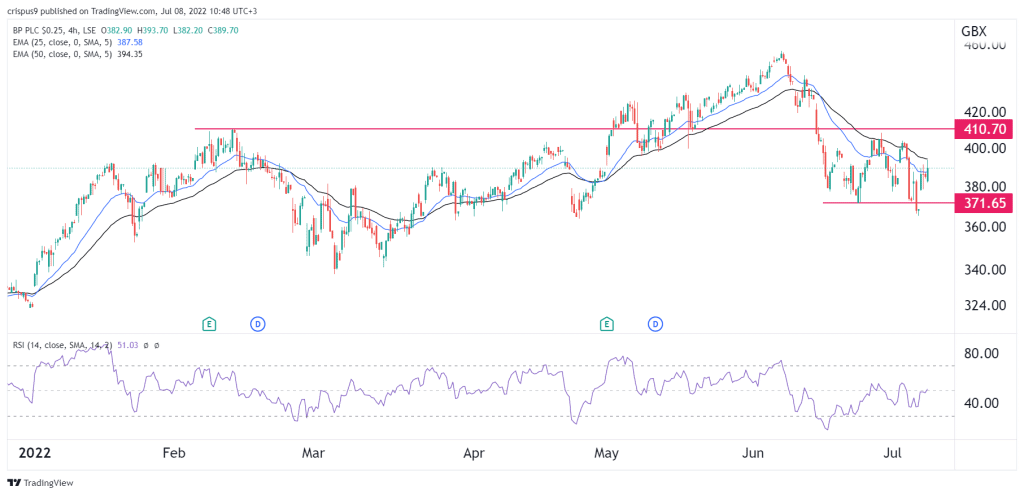

The 4H chart shows that the BP share price has been in a consolidation phase in the past few weeks. During this period, the stock has remained between the support and resistance levels at 371p and 410p. It has also moved slightly below the 25-period and 50-period moving average while the MACD is at the neutral point.

Therefore, at this stage, the outlook for BP stock price is neutral since there is no well-defined trend. A more bearish outlook will be confirmed if the stock moves below the support at 371p. On the other hand, a break above the resistance at 410p will signal that there is more upside.