- Today’s trading session has been rough for BP's share price, which is already down by a percentage point and looking likely to drop further.

Today’s trading session has been rough for BP’s share price, which is already down by a percentage point. The British oil and gas company saw huge gains in July, closing the markets up 3 percent, following one of its worst-performing months in over a year, when June saw the company dropping by more than 10 percent.

The drop in price comes as the company prepares to release its financial report in tomorrow’s trading session. However, despite the drop, many experts expect the results to be strong and revenue to improve year-over-year.

Part of the reason for such high optimism of the company is due to the current oil industry fundamentals that have seen the oil and gas prices going up. The Company, which last year made more than $160 billion, has been one of the beneficiaries of the current sanctions imposed on Russia, which has seen the shortages of oil and gases pushing the prices up.

BP Share Price Analysis

With the expected second quarter tomorrow, much of what happens in the next few trading sessions will depend on tomorrow’s results. Therefore, based on the current fundamentals available today, BP’s revenue and possibly profits are expected to significantly improve from the last quarter.

There is also a high likelihood that tomorrow’s financial report will paint a positive outlook for the company. Therefore, my BP share price analysis expects the company to recover from today’s price drops. I also expect tomorrow to be aggressively bullish following the release of the financial report.

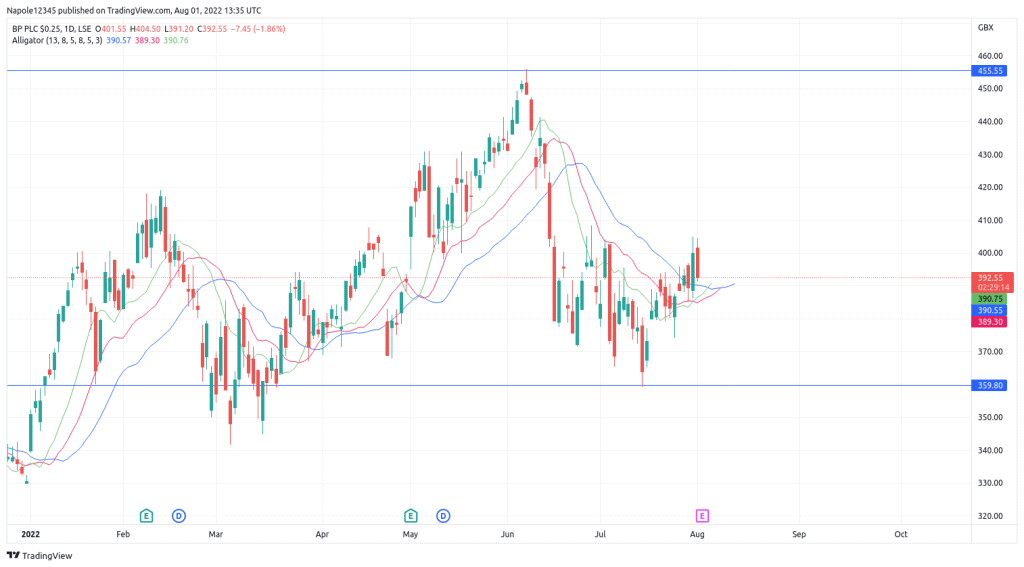

In the coming trading sessions, there is a high likelihood that we will see prices continue to rise. There is also a high likelihood that, following the release of the results, BP will trade above 400p again and possibly approach its latest price high of 455p.

My analysis will, however, be invalidated should tomorrow’s financial report be anything less than exemplary. In that case, I expect the share price to plummet and possibly trade below the 380p price level.

BP Daily Chart