- Boohoo share price has been in a steep sell-off in the past few months as concerns about the company’s growth continues.

Boohoo share price has been in a steep sell-off in the past few months as concerns about the company’s growth continues. The BOO stock crashed by about 90% from the highest level in 2020, making it one of the top fallen angels in the FTSE 250. The current price is close to the lowest level since April 2016.

Is Boohoo too cheap or is it a value trap?

Boohoo was once one of the hottest companies in London. For example, the stock rose in all weeks since December 1st, 2015 to July 3rd, 2017. During this period, the stock jumped by almost 1,000%, making it one of the best-performing shares in the UK.

Boohoo has had a spectacular downfall in the past few months. The stock has crashed by 90% from the highest point in 2021 as concerns about its business continued. As a result, its total market cap crashed from over £5 billion to about £560 million.

There are several reasons why the stock has crashed hard in the past few months. First, there are concerns about the weak British pound. The GBP/USD price has crashed to the lowest level since March 2020 and is down by more than 19% from its highest level in 2021. A weak British pound and soaring inflation is usually a negative thing for the company since it has increased the cost of imports.

Second, with inflation rising, analysts expect that the company’s demand will be relatively weak in the coming months. In fact, Boohoo has decided to slash its forward guidance several times as demand slows. Further, the company has faced competition from the likes of Shein and other firms in the sector.

Still, analysts believe that the company has become extremely undervalued. For one, the firm generated over $2.6 billion in revenue even as it moved to $6.5 million loss. Therefore, while losses are expected to continue this year, there is a likelihood that the stock is undervalued.

Boohoo share price forecast

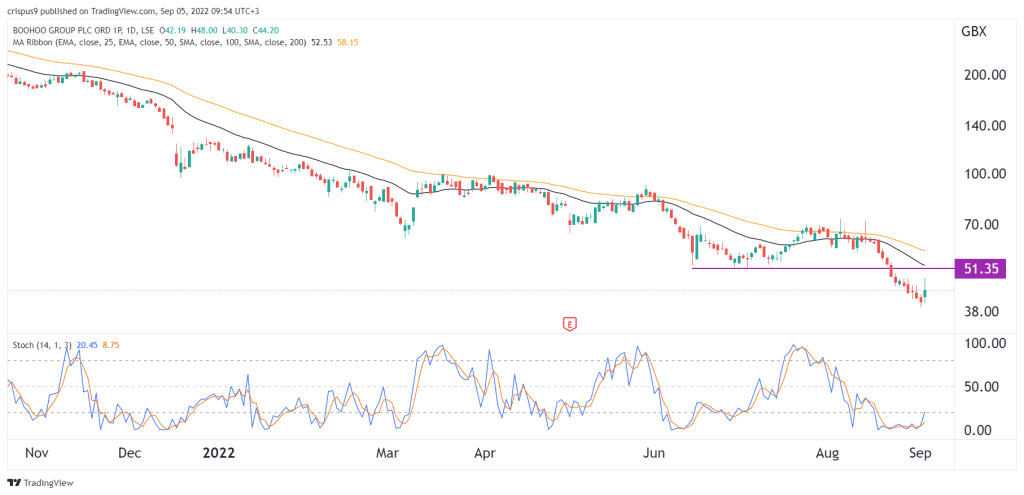

The daily chart shows that the Boohoo stock price has been in a strong bearish trend in the past few months. As it dropped, the stock moved below the important support level at 51.35p, which was the lowest level on July 5. It has then moved below all moving averages while the Stochastic Oscillator moved below the oversold level.

Therefore, the stock will likely continue falling as sellers target the key support level at 30p. A move above the resistance at 50p will invalidate the bearish view. In the long-term, however, the stock will likely resume the bullish trend.