- Bitcoin Cash price is struggling today. But the price needs to move above $550 for it to retest the multi-year high level reached during the weekend.

Bitcoin cash price did what we predicted on Friday. In our note, we mentioned that BCH would soar to $500 as the demand for the currency continued to rise. During the weekend, it jumped to $656, the highest level since 2017. However, it quickly erased those gains and is currently trading at $506.

What happened: Technical factors and rising demand helped push the price of Bitcoin cash to a multi-year high yesterday. However, this has changed today mostly due to the overall weakness of the crypto industry. The currency has dropped by more than 23% from its weekend high.

It’s not alone. Other cryptocurrencies like Bitcoin, Ripple, Ethereum, and Cardano have also dropped sharply. This performance has pushed the total market cap of cryptocurrencies below $1 trillion for the first time in more than a week.

Bitcoin cash price and other currencies are falling because of the strong US dollar due to rising risks. The greenback has risen against all major currencies as traders focus on the rising coronavirus cases in China and the political turbulence in the United States.

So, what next for Bitcoin cash price?

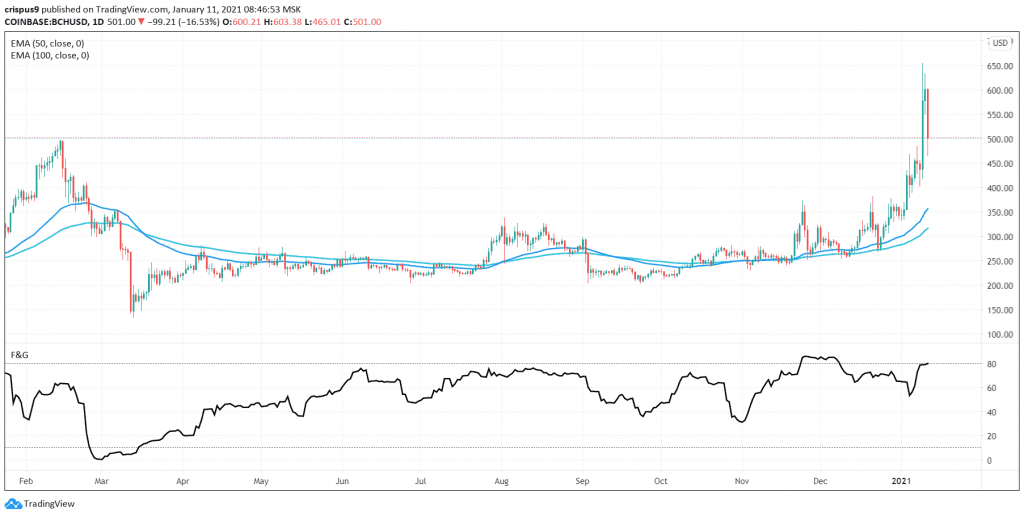

Turning to the daily chart, we see that Bitcoin cash price is under pressure today. It has fallen by more than 20% from its weekend high of $656. However, we also see that it has found substantial support at the $500 level. At the same time, the fear and greed index indicator has risen to the overbought level of 80.

Therefore, despite the current weakness, I predict that bulls will return and push the price above the YTD high later this week. This will be confirmed if the price manages to move above $550.