- The Axie Infinity price has been under intense pressure in the past few months. The AXS token is trading at $75

The Axie Infinity price has been under intense pressure in the past few months. The AXS token is trading at $75, which is sharply lower than last year’s high of $172. That is a 55% decline, which has brought its total market capitalization of over $5.2 billion.

Axie Infinity is a leading blockchain platform that has become a popular play-to-earn platform. The platform allows people from around the world to play games and earn while doing so. It also became one of the leading platforms for non-fungible token (NFT) trading.

Now, the developers are hoping to transition it to becoming one of the leading metaverse platforms in the world. They are building a platform where people can buy virtual land and other items. As such, it is transitioning itself into a platform that is similar to The Sandbox.

Recently, however, the Axie Infinity price has struggled after signs emerged that the number of users in the platform is flattening. Also, as with Enjin, there are worries about whether these metaverse projects will do well in a period of high-interest rates. Besides, the Federal Reserve has hinted that it will hike rates more than three times this year.

Axie Infinity price prediction

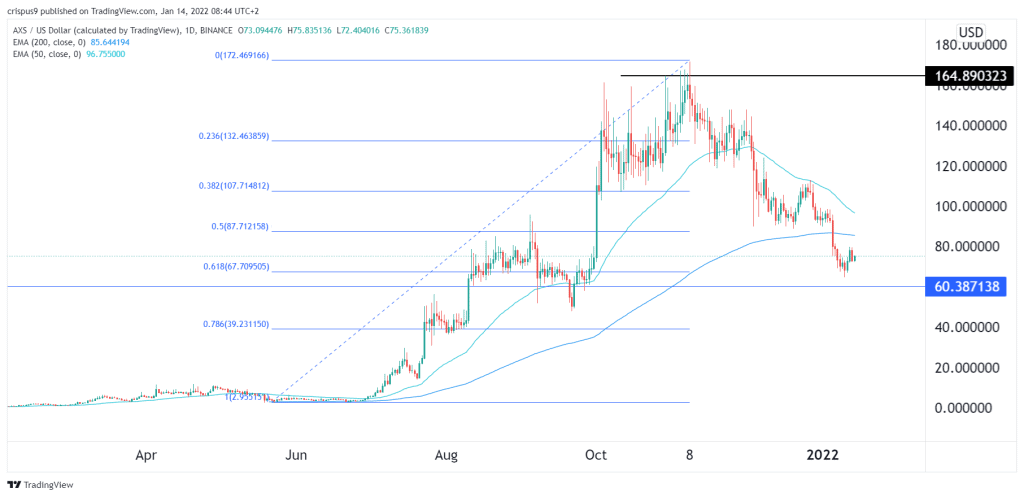

The daily chart shows that the AXS price has been under pressure in the past few months. The price has managed to drop to the 61.8% Fibonacci retracement level. It has also moved below the 25-day and 50-day moving averages (MA). It is also closer to forming a death cross, which happens when the 50-day and 200-day MA are about to make a crossover.

Therefore, there is a likelihood that the Axie Infinity price will keep falling in the near term. That could push it to the key support at around $60. However, in the long-term, there is a likelihood that the price will bounce back as investors buy the dips.