- Aviva share price is down by half a percentage point today, extending a strong bearish trend that started eight days ago.

Aviva’s share price is up by half a percentage point in today’s trading session. This is after the recent slide that saw the prices move from 442p to 405 in the past eight days.

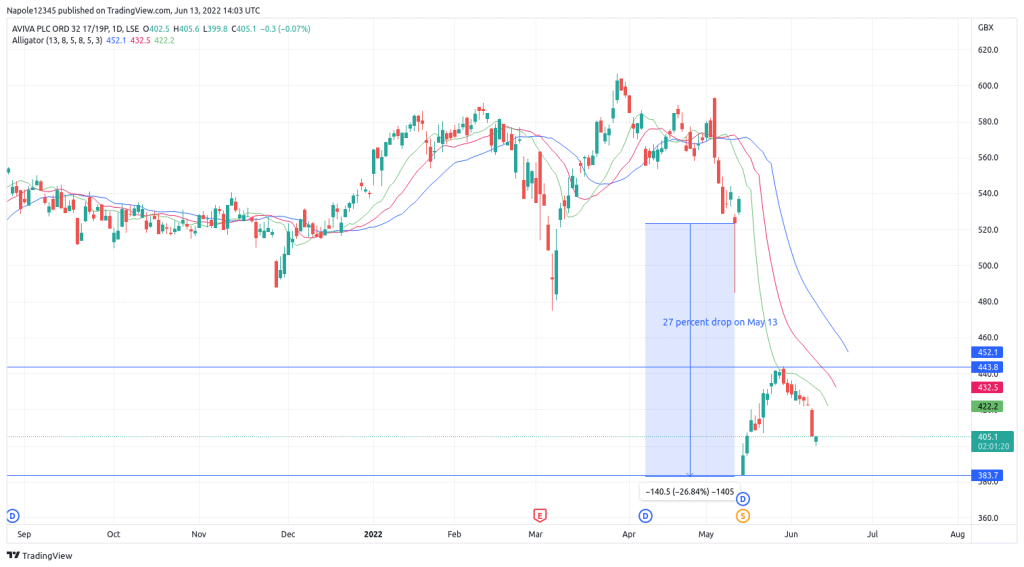

The current price recovery also comes a month after the share prices dropped by 27 per cent on May 13. The price drop in May resulted from a contentious shareholders’ meeting that was characterized by controversies that included sexist remarks toward the company’s CEO, Amanda Blanc, by its shareholders.

Should investors be concerned?

As an investor looking at the current share price chart, it is likely to come to the conclusion that the recent price drop may persist. Although such an evaluation of what is currently happening in the markets is logical, the drop is temporary.

The current drop in share prices is a response to the company’s B share scheme, where the company returned £3.75bn to its shareholders. The process involved in a B share scheme is similar to the special dividend. However, the B share scheme is regarded by many as more tax-efficient, hence mostly favoured by investors looking for high returns.

Aviva’s CEO also announced following the shareholders’ meeting that the company may be able to give more cash back in the form of a B share scheme. This is after the company announced a 5 per cent increase in general insurance and improved capital position. According to financial data, the company’s capital strength stood at 198 per cent Solvency II ratio, a key measure of capital strength. Regulators consider a 100 per cent level as the minimum that insurers should hold.

Aviva Share Price Prediction

Today’s trading session is up by half a percentage point. This is after the past eight days have seen a price decline of 9 per cent. So despite the chart below showing a strong bearish trend, there is a high likelihood that we will start seeing Aviva prices recover in the markets. The recent strong financial records and improving market conditions are likely to push the current price of 405p to trade above the 420p price level.

However, in the unlikely event that the current economic situation continues to deteriorate and inflation continues to go up, my bullish analysis will be invalidated. It will also mean a possible push to the downside, which will see prices trading below the 400p price level.

Aviva Daily Chart