- The Aviva share price could cement the recovery move if the bulls uncap the resistance at the 438.5p price mark.

The Aviva share price continued its upward push, opening higher with a bullish gap this Tuesday after the resumption of market activities on the London Stock Exchange following the long weekend holiday. However, the bears appear intent to close this gap and have pushed prices marginally lower as of writing. The current situation threatens to put a stop to the 4-day winning streak on the Aviva share price, as it aims to resume its recovery following a recent price correction.

Despite the bears shaving off the stock’s value only marginally, prospects for the stock’s advance remain high. The market appears to be responding to the exit of Aviva’s group brand and reputation; director Raj Kumar is leaving the UK’s largest insurance firm after a 9-year stint.

Kumar had joined the firm as global head of marketing strategy and planning, assuming the role of the head of the firm’s branding and reputation division four years ago. He is credited with leading the company’s rebranding project in 2021, which seems to have paid off as the stock pushed off its pandemic-level lows.

The recent surge in the Aviva share price also comes off the company’s completion of a $1.3billion share buyback program and the appointment of Charlotte Jones as the new Chief Financial Officer (CFO) of the company.

Just days after the Uk insurance firm’s CEO identified flooding as the UK’s biggest environmental risk, the firm joined Britain’s FloodRe insurance scheme to provide additional funding for homeowners to shore up their resilience to floods. The project will provide access to an extra 10,000 pounds of reimbursements above any costs of losses or repairs due to flooding.

The latest 12-month price target from 16 institutional analysts points to a median price of 511.43p, with the price band extremes set at 540p and 480p, respectively. This price target allows for an upside potential of 17.9%.

Aviva Share Price Outlook

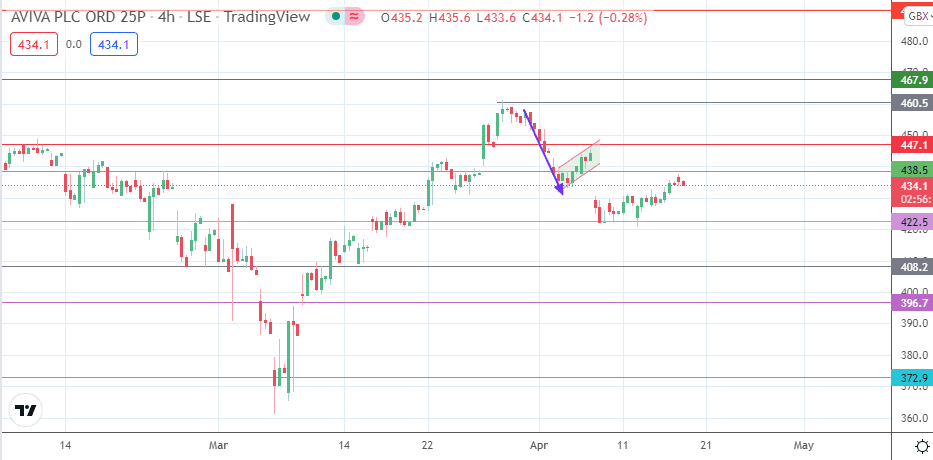

The bounce on the 422.5 support follows the completion of the bearish flag’s measured move. This signals the completion of the short-term retracement and the start of the renewed minor trend. This recovery move must break the 438.5 resistance to continue, targeting 447.1 initially before 460.5 (29 March high) comes into focus. Additional resistance is seen at the 467.9 price mark (10 November 2016 high).

On the flip side, rejection at the 438.5 resistance could prompt a resumption of the selloff, providing the impetus for a retest of 422.5 initially. If the bears degrade this support level, 408.2 (24 February low) and 396.7 (1 November 2021 and 9 March 2022 lows) are additional support targets.

Aviva: 4-Hour Chart

Follow Eno on Twitter.