- The AVAX price has been struggling lately even as its ecosystem growth continues. Avalanche is trading at $67.07

The AVAX price has been struggling lately, even as its ecosystem growth continues. Avalanche is trading at $67.07, about 32% below the highest level this year. In addition, its price is at the lowest it has been since February 24th, bringing its total market cap to about $17 billion.

Avalanche is a fast-growing chain that seeks to become a better alternative to Ethereum and other layers 1 networks. Its biggest claim to fame is its blazingly fast speeds and lower transaction costs. While Ethereum apps process less than 20 transactions per second (tps), Avalanche is able to handle over 4,500.

AVAX latest news

It seems like Avalanche’s story and its Rush program is resonating with developers. According to DeFi Llama, there are now over 200 DeFi applications in its ecosystem that have a TVL of over $10 billion. This makes it the fourth-biggest platform in the world after Ethereum, Terra, and BNB Chain. And if the growth continues, it will soon overtake BNB, a platform that is showing signs of a slowdown.

What’s notable about the Avalanche DeFi ecosystem is that the market dominance of Aave is about 28%. There are five platforms with a TVL of over $1 billion. A good number of them have a TVL of $100 and above. In comparison, in a platform like Terra, Anchor Protocol has a dominance of over 50%. Another notable factor is that its ecosystem in other industries like NFTs and the metaverse is also growing rapidly. For example, early this month, the developers launched a $290 million fund to incentivize more metaverse creators.

AVAX price prediction

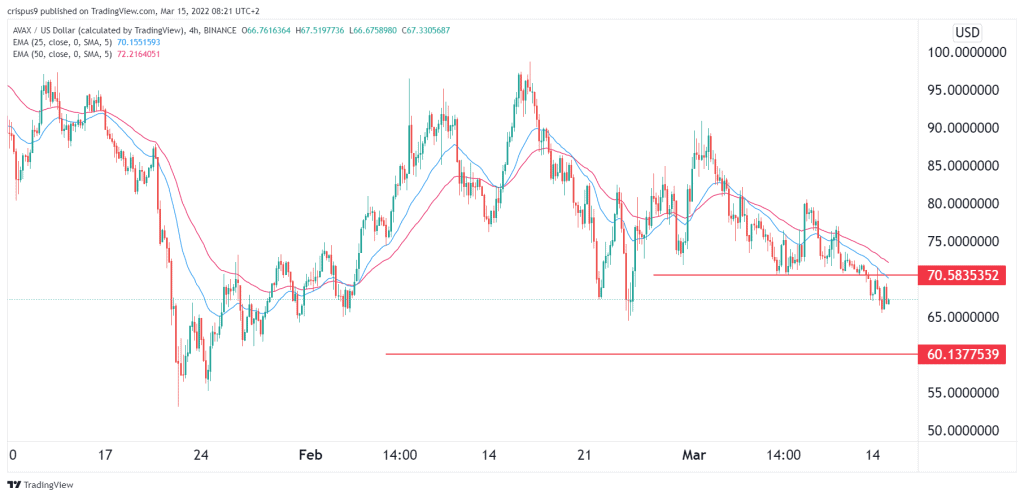

The four-hour chart shows that the Avalanche price has been in a strong bearish trend in the past few days. As it dropped, the price managed to move below the key support level at $70.58, which was the lowest level on March 7th. It has also moved below the 25-day and 50-day moving averages while the MACD has been in a bearish trend.

Therefore, there is a likelihood that the AVAX price will continue falling in the near term as bears target the next key support level at $60. This view will be invalidated if the price moves above the key resistance at $75.