- What is the outlook of the Avalanche price? We explain whether AVAX is a good investment and the reason it is crashing.

The Avalanche price moved below the bearish pennant pattern as concerns about the Fed continued. As a result, AVAX tumbled to a low of $28.8, which was the lowest level since Friday last week. However, the coin is still substantially above last week’s low of $22.58. Other altcoins like Cronos, Kadena, and Algorand also made a major pullback.

There are four main reasons why the AVAX price made a strong bearish breakout. First, there are concerns about the blockchain industry after the collapse of Terra and its ecosystem. Investors now believe that even the most successful coins can disappear within a short period. Second, Avalanche’s DeFi ecosystem has plummeted. Data shows that the total value locked in Avalanche has declined by more than half, and it currently stands at $5 billion.

The Avalanche price is crashing as investors avoid fighting the Fed. The bank has already committed that it will not save the market this time. On Wednesday, Powell reiterated that there will be a pain in the market as it fights inflation.

Finally, the decline is in line with the recent correlation of digital assets and stocks. The Dow Jones declined by more than 1,200 points on Wednesday, while the tech-heavy Nasdaq 100 declined by more than 600 points after the weak earnings by Target and Walmart.

Avalanche price prediction

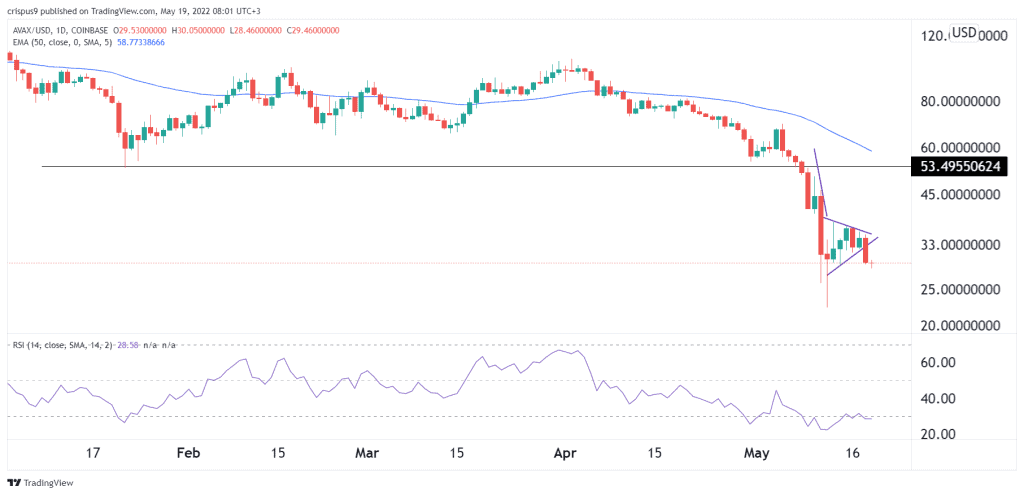

The daily chart shows that the AVAX price formed a bearish pennant pattern. This is usually one of the most accurate sell signals in the market. However, it has managed to move below the lower side of this pennant.

The 25-day and 50-day moving averages are also supporting the sell-off. Therefore, the next key level to watch will be last week’s low at $22, which was the lowest level last week. A move above the resistance level at $33 will invalidate the bearish outlook.