- What is the outlook of the Diageo share price? We explain what to expect now that analysts are still upbeat about the stock?

The Diageo share price has done relatively well as the reopening has boosted the company’s business globally. DGE shares have jumped by 74% from the lowest level in 2020. They have also risen by more than 20% this year and outperformed the FTSE 100, which is up by less than 10%.

Diageo recovery accelerates

Diageo is a leading beer, wine, whisky, and vodka manufacturer with operations in most countries. The company is well known because of its market-leading brands like Guinness, Senator, Gilbeys, Ciroc, and Smirnoff among others.

Diageo, like all companies in the industry, was deeply impacted by the Covid-19 pandemic. Besides, many bars, hotels, and nightclubs were deemed as non-essential and ordered to close in key countries.

Still, despite the pandemic, the company’s business did well. Results published in July showed that the total sales rose by 8.3% to more than 12.7 billion pounds. Its organic sales rose by 16% while the American division rose by 20.2%.

As a result, its total operating profit rose by 74.6% to more than 3.7 billion pounds while its net cash from operating activities rose to 3.7 billion.

Analysts are generally optimistic about the Diageo share price. Most analysts tracked by Marketbeat have a buy rating while the rest have a hold rating. For example, analysts at Jefferies expects the stock will jump to 4,200p, which is substantially higher than the current 3,570p. Similarly, analysts at Barclays see it rising to 4,000p while those at JP Morgan see it rising to 3,700p.

Diageo share price forecast

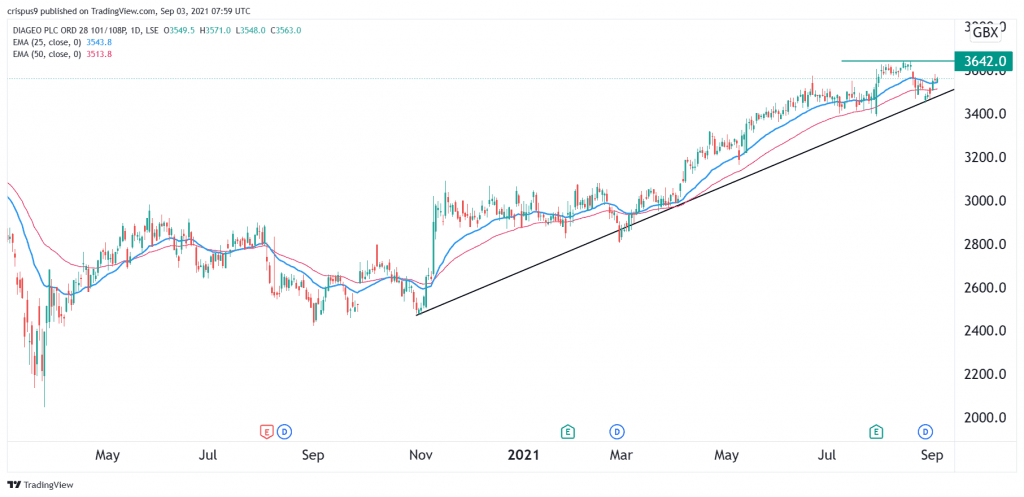

The daily chart shows that the DGE share price has done relatively well recently. The stock is hovering close to the year-to-date high of 3,642p. It is also stuck at the 25-day and 50-day moving averages. It is also slightly above the black ascending trendline while the MACD has kept rising.

Therefore, the outlook of the Diageo share price is currently neutral. A strong bullish trend will be validated if the price manages to move above the YTD high of 3,642p. On the flip side, a drop below 3,500p will invalidate this view.