- The discovery of new COVID-19 cases in Beijing could prompt new bearish Alibaba stock forecasts if new lockdowns come into effect.

Alibaba stock forecasts may remain bullish in the long term, but the stock continues to take a beating in the short term. In Hong Kong trading, Alibaba and other tech stocks found themselves in the red as uncertainty brought about by China’s detection of a new cluster of COVID-19 cases spooked investors. Alibaba Group Holdings stock lost 4.24% in Hong Kong trading, coming closely behind Nio as the EV maker topped the losers’ chart among Chinese tech and EV stocks. JD.com, Baidu, Tencent, Li Auto, Xpeng and Nio saw red on the day.

The bearish sentiment has not carried on into the New York session, where the stock is trading 5.6% higher as it attempts to erase the losses of the last three days. However, the uptick appears limited as traders in the New York Stock Exchange apply caution ahead of tomorrow’s interest rate decision by the Fed.

The predominant headwind which will dictate Alibaba stock forecasts in the short term remains events from China. Bloomberg reports that an outbreak traced to a local bar has triggered new COVID-19 restrictions. Even stricter controls than an earlier round of lockdowns applied to Beijing and Shanghai could be in the works as the local authorities say this latest outbreak is proving hard to control.

Alibaba Stock Forecast

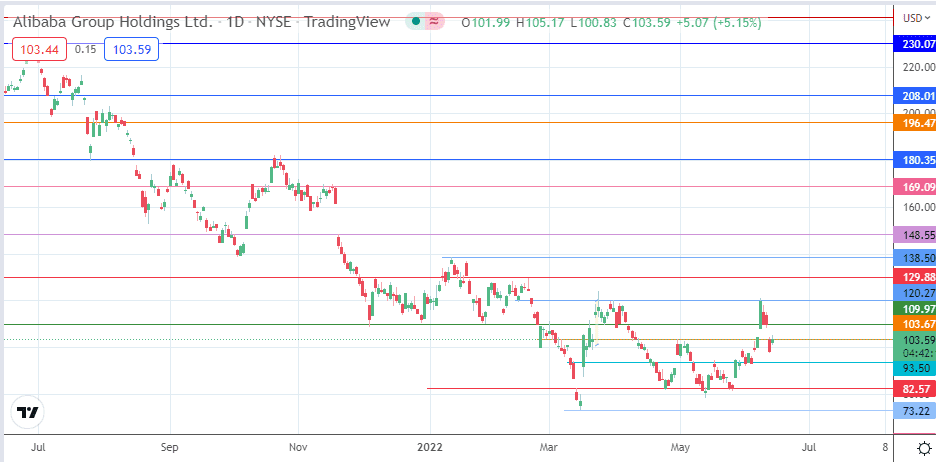

The active daily candle is challenging the resistance at 103.67. A break of this level is required to attain the 109.97 barrier, covering the downside gap of 13 June in the process. Above this level, the 120.27 resistance, the site of the 30 March/8 June 2022 highs, becomes an additional target for the bulls. 129.88 (7 December 2021 and 17 February 2022 highs) and the 138.50 price mark (12 January 2022 high) form additional targets to the north.

On the flip side, rejection at the 103.67 resistance (29 April high) forms a reasonable basis for a pullback towards 93.50, the site of the 2 June 2022 low. A breakdown below this level will send the price action toward the 12 May/25 May double bottom troughs at 82.57. An additional harvest point for the bears comes into the picture at 73.22 (15 March low) if there is further price deterioration.

BABA: Daily Chart