- The Alibaba share price rallied nearly 37% on Wednesday, but headwinds still persist, leaving the stock vulnerable below 110.

The Alibaba share price has rallied on Thursday, following a general rally in tech shares in Hong Kong. This rally is coming on the back of reports of government support and a workforce trimming plan as part of a cost-cutting process.

A 36.76% rally on Wednesday has been followed by a somewhat muted open on Thursday, even as a report by global investment firm UOB Kay Hian quotes Chinese Vice Premier Liu He as pledging the support of the Chinese government for local companies that seek to list overseas. This is seen as a morale-booster for Chinese tech shares, which have been battered in the last year and a half following severe regulatory crackdowns.

Notable shark tank investor Kevin O’ Leary called the bottom on Chinese stocks in a CNBC interview and indicated he had purchased shares in Alibaba, prompting a flood of demand on the stock. This trigger contributed to the surge in the Alibaba share price on Wednesday.

Alibaba Share Price Outlook

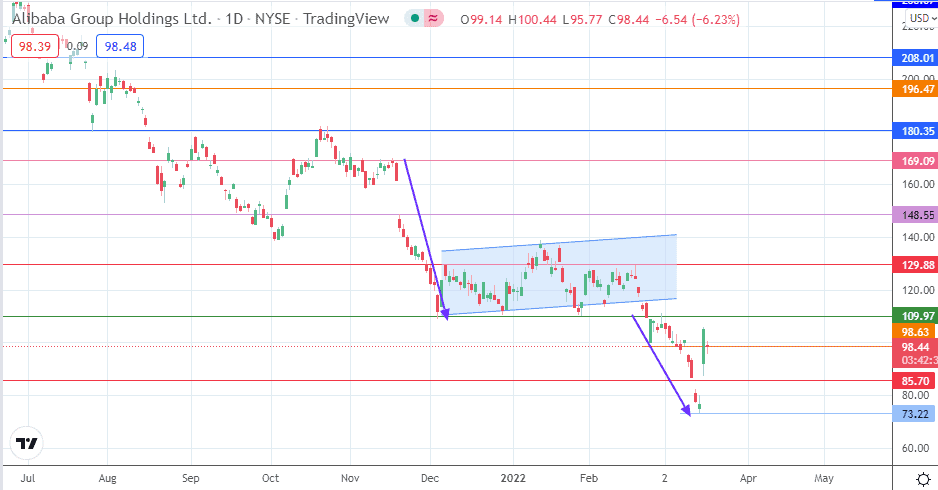

Currently, the Alibaba share price sits on the 98.63 price mark (7 March low). The recovery from the 15 March 2022 low follows the completion of the bearish flag on the daily chart. If the bulls extend the recovery above the 109.97 resistance (27 September 2016 and 1 March 2022 high), we could see a further advance towards 129.88. 148.55 (18 November 2021 high) and 169.09 (11 October and 16 November 2021 highs) are additional northbound targets.

On the flip side, a decline from present levels (98.63 resistance mark) retests the 85.70 support (23 December 2016 and 11 March 2022 lows). If the bulls fail to defend this support, then the decline towards 73.22 will be on course. Any further dips from this level tests lows last seen in 2016.

Alibaba: Daily Chart

Follow Eno on Twitter.