- AAVE price has fallen by 80% from ATH. So, what next for the once high-flying cryptocurrency and what to expect next?

The AAVE price has not been left behind in the ongoing rout of risky assets like cryptocurrencies and technology stocks. The coin has dropped to about $138, which is substantially lower than its all-time high of $705. However, it is also trading at a key support level, bringing its total market capitalization to about $1.8 billion.

DeFi challenges remain

AAVE is one of the most popular decentralized finance (DeFi) platforms globally. The developers created an open-source platform that enables people to lend and borrow cryptocurrencies. Since Aave is an open-source platform with smart contract features, some developers have even built applications on top of its network. The most popular one is Aavegotchi, which describes itself as a DeFi-staked crypto-collectibles network.

The AAVE price decline has coincided with the overall fading demand of its network. A good way to look at this is to consider the total value locked (TVL) performance in the platform. According to DeFi Llama, the TVL in Aave has collapsed to about $11.71 billion. This value is substantially lower than its all-time high of near $20 billion that was achieved on October 29th in, 2021.

Another notable observation is that other DeFi tokens have dropped as well. For example, the Uniswap price has collapsed by more than 80% from its all-time high, while Maker has dropped by more than 70%. Further, there are concerns that the industry is getting incredibly competitive.

Is AAVE a good investment?

A common question is whether AAVE is a good investment or whether it is safe to buy the coin. To answer that, we need to explain why the coin’s price has dropped sharply in the past few months. First, as you have noted, its decline is not an isolated situation considering that other DeFi tokens have all dropped sharply in the past few months. Therefore, this performance is because of the close correlation between cryptocurrencies.

Second, there are concerns about the industry as the Federal Reserve starts hiking interest rates. The bank is expected to hike rates about three times this year. Therefore, it is unclear how DeFi coins will react when this hiking starts.

Third, there is the fact that many investors believe that the DeFi industry is extremely overvalued while others see it as being a fad. For one, the industry has over $100 billion in total value locked (TVL), which was higher than two years ago. Therefore, it is bound to correct whenever an asset makes that parabolic move.

AAVE price prediction

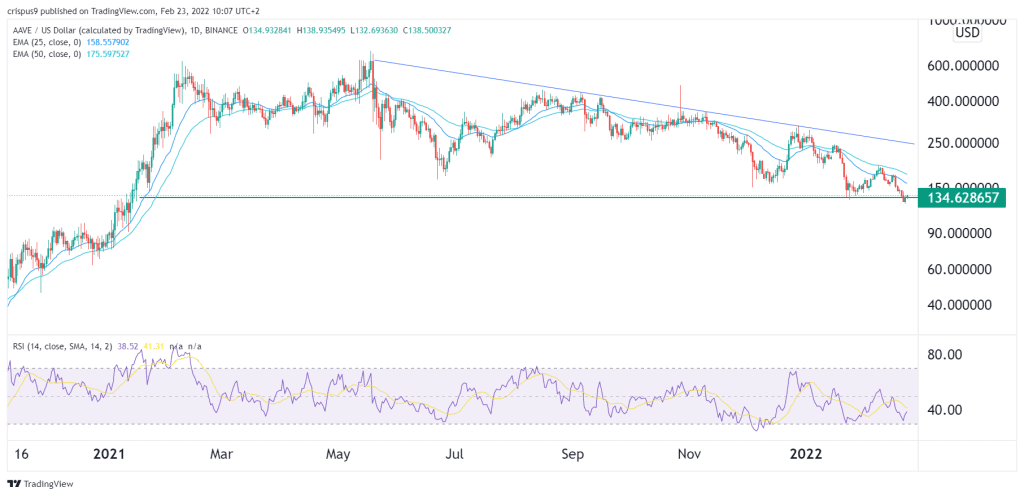

On the 1D chart, we see that the AAVE coin price has been in a strong bearish trend in the past few weeks. Along the way, the coin remains below the descending trendline shown in blue.

The downward trend is also supported by the 25-day and 50-day exponential moving averages (EMA). A closer look also shows that it has formed a descending triangle pattern. Therefore, there is a likelihood that the coin will have a bearish breakdown as sellers target the next key support level at $100. This view will be invalidated if the coin moves above $150.