- EURGBP resumed the downtrend after a short break yesterday. The pair is under selling pressure after a big miss in the German Zew survey.

EURGBP resumed the downtrend after a short break yesterday. The pair is under selling pressure after a big miss in the German Zew survey. The February 2020 ZEW economic sentiment came in at 8.7 much worse than the expectations of 21.5 the previous reading was at 26.7. The Current conditions survey was also a big miss, it came in at -15.7 below the forecasts of -10.3 the last reading was -9.5. The Eurozone ZEW economic sentiment registered in at 10.4 below the previous reading of 25.6.

ZEW Institute said that the negative effects of the coronavirus spread on global trade have been causing a severe decline of the Zew indicator of economic sentiment for Germany. The beginning of 2020 saw a worse than expected development of the German economy.

On the other side, the UK Claimant Count Rate dropped to 3.4% in January from the previous 3.5%. The Unemployment Rate for December came in at 3.8% in line with expectations. The UK Average Earnings Excluding Bonus came in at 3.2%, below the forecasts of 3.3% in December.

Given the poor fundamental data, what can help the common currency is a stimulus from the ECB.

Read our Best Trading Ideas for 2020.

EURGBP Resistance and Support

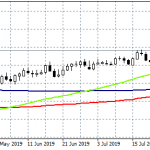

EURGBP is 0.40% lower at 0.8295 at two-month lows as the bears are driving the pair to lower levels. On the downside, immediate support for the EURGBP stands at 0.8291 the daily low. Next support area to watch is the December 16th low at 0.8303, which guards the 2019 lows at 0.8278.

On the other side, the first resistance will be met at 0.8348 the daily top. A break above will reach the next supply zone at 0.8401 the high from February 13th. The critical resistance level is at 0.8468 the 50-day moving average.