- Suzlon Energy share price has been trading in a tight range of between ₹65-₹66 for the last week and a near-term breakout is unlikely.

Suzlon Energy share price has extended its consolidation, trading at ₹65.70 after declining by 0.3% at the time of writing. The stock has been trading in a tight range of between ₹65-₹66 for the last five sessions, but maintains a stable RSI of 51 on the daily time frame. The underlying bullish momentum is supported by strong financials, epitomised by its 356% year-on-year rise in consolidated net profit in Q2.

The current downward pressure on Suzlon Energy share price is primarily due to a prolonged period of profit taking. Nonetheless, it has risen by 6.3% from its mid-June lows of ₹61.76, signaling a buildup of upside traction. Also, the current price Suzlon (NSE: SUZLON) remains significantly above its 52-week highs, although below its YTD highs of ₹74.30.

A key driver of its optimistic outlook is a robust debt-to-equity ratio, which stands at 0.18 as of this writing, down from much higher levels. That signals that the company is on its way to becoming debt-free, which will free up its capital for use in growth.

Furthermore, Suzlon’s strong position as an OEM gives it an edge in the highly-competitive renewable energy market. The Indian government’s increasing investment in green energy and promotion of “make in India” campaign also spells good news for the company. That said, Suzlon Energy share price is at 43x its book value, implying that it is trading at a premium relative to its peers.

Suzlon Energy Share Price Prediction

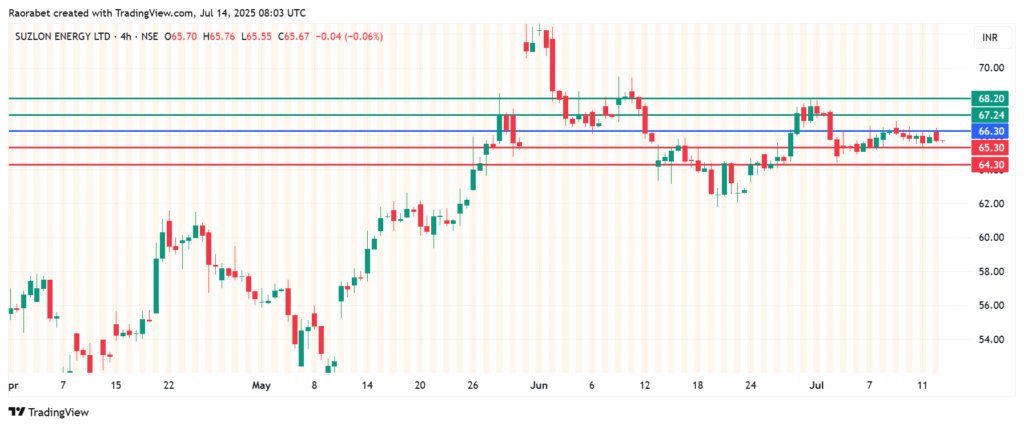

The momentum on Suzlon Energy share price favours the sellers to be in control below the pivot mark at ₹66.30. The stock will likely find its initial support at ₹65.30. However, an extended control by the sellers will break below that level and test ₹64.30.

On the other hand, going above ₹66.30 will shift the momentum to the upside. In that case, the gains will likely meet the first resistance at ₹67.24. Breaking above that level will invalidate the downside narrative. Also, such momentum could clear the path to test ₹68.20.