- Nvidia stock price made history after becoming the world's first $4 trillion company and its revenue stream is about to expand.

Nvidia stock price retested its record highs of $164 on Thursday as buyers continue to seek a piece of the world’s first $4 trillion cap company. Investors are focused on record valuation and AI demand, with Nvidia’s stock riding a powerful tailwind. The company’s Q2 earnings call is expected in late July or early August and that could determine whether the current momentum will hold.

Beyond the sentiment-driven buying, Nvidia CEO Jensen Huang is set to meet Chinese officials and a deal on custom-made AI chips could be on the cards. Nvidia (NASDAQ: NVDA) is reportedly working on developing chips a new class of AI chips meant for China to go around the export restrictions imposed by the US government.

The company revealed earlier this year that restrictions on access to China could cost it $8 billion in Q2 revenue. To get around this hudrle, the company is developing Blackwell variants like the B40 meant for China, B200 A for mid-range servers, GB300 for ultraperformance and the GB10 for SiP products.

The bullish momentum on Nvidia stock price is likely to remain in place, thanks to a strong demand for its AI chips and rising adoption of AI technology. While Nvidia’s valuation remains elevated at roughly 34 times forward earnings, the combination of AI enthusiasm, strategic clarity, and strong fundamentals is keeping investor appetite robust.

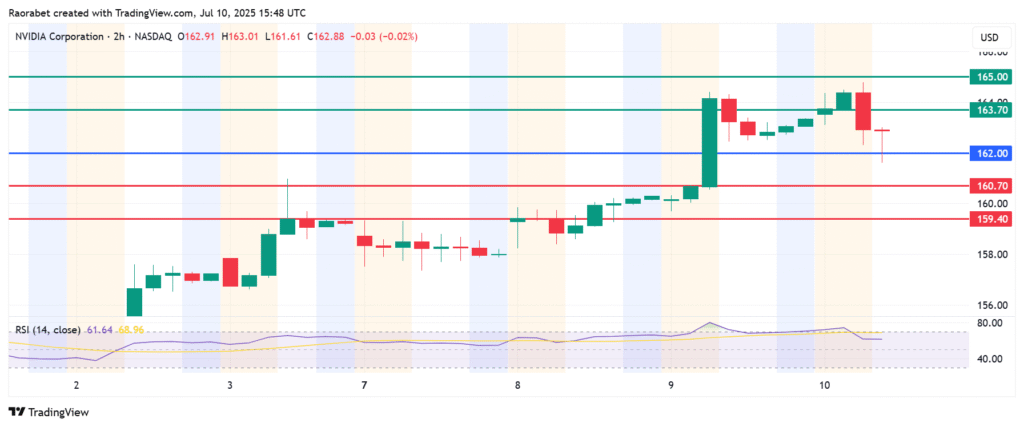

Nvidia Stock Price Prediction

Nvidia stock price pivots at $162 and action above that level will favour the upside to continue. With the buyers in control, the first resistance will likely be at $163.70. Breaking above that level will signal a stronger momentum that could push the action to test $165.00.

Alternatively, going below $162 will signal a shift the momentum to the downside, with the first support likely to be at $160.70. The upside narrative will be invalid if the price breaks below that level. Also, an extended control by the sellers could push the action lower and test $159.40.