- Gabriel India share price is o an upbeat momentum as investors buy into its restructuring plans. Is there room for further near-term gains?

Gabriel India share price continued to put up a strong show at the NSE today, with its share price soaring nearly 16%, touching ₹976.20. At one point during the day, the stock reached an intraday high of ₹1,011.30, which set off a 20% upper circuit and continued its recent rise that has caught the attention of investors.

The company has made a big change to its structure by unveiling a composite scheme that includes splitting off its AIPL automotive division and merging Anchemco India into the parent company.

Gabriel India (NSE: GABRIEL) is restructuring its business by spinning off its AIPL automotive division and bringing Anchemco India into the fold. This will help the company focus more, work more efficiently, and maybe even make more money. This kind of big transformation in a corporation usually tells investors that the company is serious about growth and looking to the future.

Gabriel India stock price has gone up more than 80% in the last seven sessions, with the huge jump caused by both the announcement of the restructure and technical buying momentum. Analysts have seen breakouts on the stock’s chart, which are supported by large trading volumes, which adds to the positive mood.

It’s apparent that investors think that the price of Gabriel India shares has picked up momentum and that the change would lead to fresh growth projections. It’s difficult to know if that will happen in the long run, but the market loves the way it’s going in right now.

Gabriel India Share Price Prediction

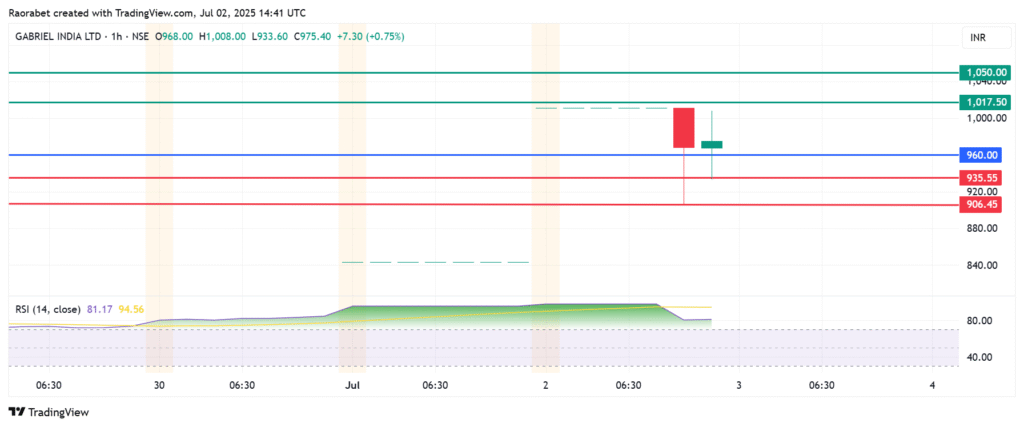

The momentum on Gabriel India share price favours the upside to continue above the pivot mark at ₹960. That will likely see primary resistance established at ₹1,017. However, an extended control by the buyers will break above that level and potentially test ₹1,050 psychological resistance.

Alternatively, the stock could break below ₹960 and invite the sellers to take control. In that case, the first support will likely be at ₹935.55. The upside narrative will be invalid if the price breaks below that level. Also, an extended control by the sellers could send the action lower to test ₹906.45.

This article is also available in: Polski, Nederlands, हिन्दी, Deutsch, Italiano, Español, Türkçe.