- Check out the technical outlook for Brent crude oil prices amid the escalating tensions between Israel and Iran.

On Thursday morning, the Brent crude oil prices rose above $77 per barrel, reaching an over four-month high, in response to the escalating tensions between Iran and Israel.

The latest news reported that this morning, Israel attacked Iran’s Arak heavy water reactor, after the announcement of Israeli President Isaac Herzog about dismantling Iran’s nuclear program.

Adding to signals that Washington might be ready to enter the war, as the senior US officials are reportedly preparing for a possible strike on Iran in the coming days. On the other hand, the signals remain mixed because the white house has given little indication of when the US would support strikes on Tehran’s nuclear facilities.

The Strait of Hormuz is the main source of the market’s fear because it’s the vital route for a fifth of global crude. Adding to the factors affecting crude oil prices, the Federal Reserve kept interest rates on Wednesday, but confirmed that there are two possible cuts by year-end, which will support economic growth and boost oil demand.

The technical outlook for the Brent Crude Oil Prices:

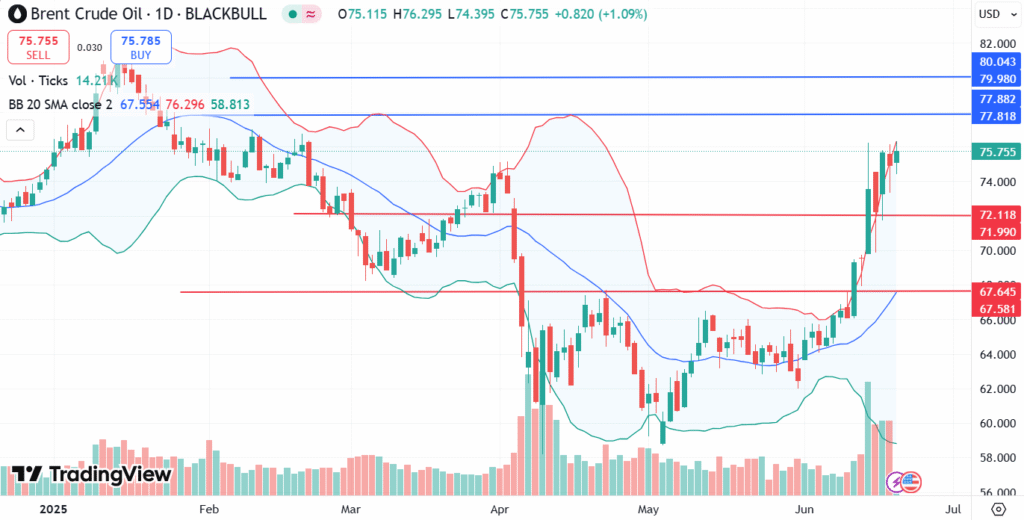

From the technical perspective, the Brent crude oil price consolidates around $75 per barrel, under the pressure of the resistance at the $77.00 level. During the escalating tensions between Israel and Iran, the buying momentum might be increased due to the increasing oil demand accordingly. A clear day close above the $77.88 level could support the oil price to reach the psychological level at $80.04.

On the bearish side, if the Brent crude oil prices lose their momentum above $75.66, they could be exposed to a downward move towards a lower level at $72.11 and then the $67.64 level.

OPEC is stuck between market supply &demand and Geopolitical tensions:

- There are escalating investment concerns, since OPEC warned of a $17.4 trillion gap in oil and gas spending over 25 years.

- OPEC+ decided to start adding 411,000 barrels daily to the global oil market in May.

- Apart from this, oil prices surged due to Israel’s attack on Iranian nuclear facilities.

- This war will put pressure on the oil supply and may cause a change in OPEC’s decision, affecting oil prices accordingly.