- The Dow Jones Index snapped a three-week winning streak last week, and resumes trading with two of its stocks in sour fundamentals

The Dow Jones Index closed trading on Friday with its first weekly loss in four weeks, underlined by renewed trade tariff war fears. However, the set up has since changed after US President Donald Trump suspended the 50% tariffs against imports from the EU until at least July 9. Therefore, traders will be back with renewed confidence that will likely ensure that the index ends the month on a winning note.

US Futures were up in the early hours on Tuesday, setting the tone for the rest of the market when the opening bells ring. The S&P 500 Index Futures were up by 1.1%, while the NASDAQ Futures had gained 1.5% at the time of writing, mirroring the upbeat performance of European equities. In addition, the CNN Fear and Greed Index, which gauges investor sentiment, was at 64 on a scale of 100, indicating a “Greed” sentiment. This set up will likely see the Dow Jones Index register gains in the near-term.

The Dow Jones Index’s previous heaviest-weighted stock, UnitedHealth Group (NYSE: UNH) faces tumultuous times. America’s largest health insurer faces rising pressure from a blend of regulatory scrutiny and three CEO changes in under six months. Elsewhere, Apple (NASDAQ: AAPL) could be limited by the FUD sentiment created by President Trump’s threat to impose 25% tariffs on iPhone imports. That said, multiple stocks in the Index will likely be bumped up should Nvidia (NASDAQ: NVDA) earnings beat forecasts .

Dow Jones Index Prediction

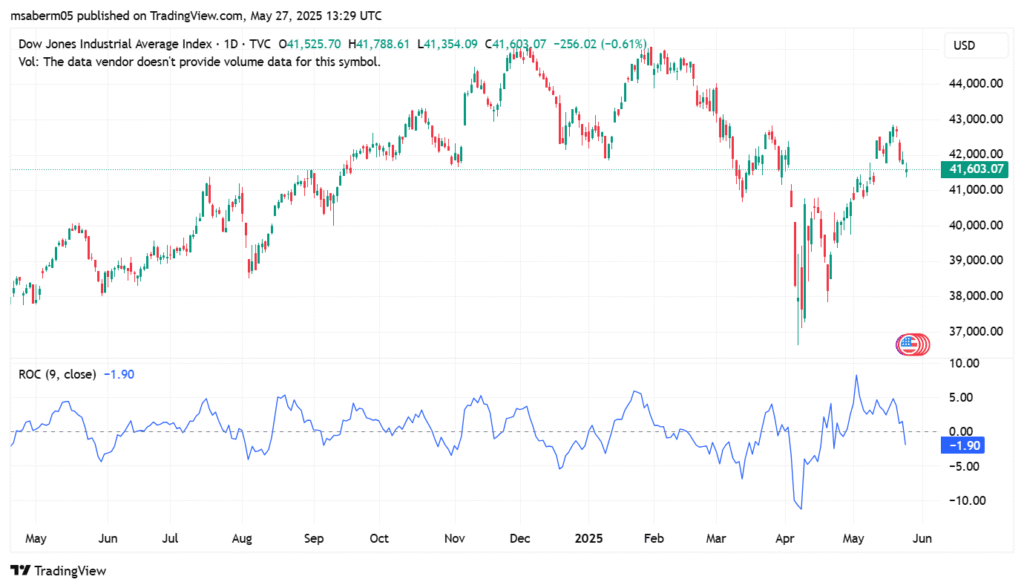

The Dow Jones Index pivot mark is at 41,590 points and the upside momentum looks likely to prevail. It will likely meet initial resistance at 41,975. However, action will go above that level if buyers extend their control. That could clear the path to test the next barrier at 42,327.

Alternatively, the index could break below 41,590 points, inviting the sellers to take control. If that happens, the first support will likely be at 41,275, below which the upside narrative will be invalid. In addition, an extended control by the sellers could take the action lower and test 40,920 points.

📰 Wall Street Rallies After Trump Eases EU Tariff Threat

Megacap tech stocks led gains, with Nvidia climbing nearly 3% ahead of its earnings report. Consumer confidence surprised to the upside, and long-term bond yields fell, reflecting strong demand for safe-haven assets. Meanwhile, investors await upcoming inflation data and remarks from Fed officials later this week.

📊 Markets & Economic Highlights

Index/Asset Movement Dow Jones +392.44 pts (+0.94%) to 41,995.51 S&P 500 +77.66 pts (+1.33%) to 5,880.48 Nasdaq Composite +333.38 pts (+1.78%) to 19,070.58 Nvidia (NVDA) +2.7%, ahead of earnings (Wed, post-close) All 11 S&P Sectors Gained, led by Consumer Discretionary & Info Tech Consumer Confidence Index Rose to 98 in May (vs. 87 expected) U.S. 30-Year Treasury Yield Dropped sharply; biggest one-day fall since late April Upcoming Data Fed minutes (Wed), PCE inflation (Fri), Q1 GDP second estimate Fed Commentary Kashkari: Keep rates steady until tariff impact on inflation is clearer Temu’s Parent (PDD Holdings) -17% after Q1 revenue miss US Stocks Surge on EU Tariff Delay and Trade Optimism

The United States stock market experienced a significant growth spike on Tuesday, unveiling a 3% increase over the holiday period. The rebound followed the President's announcement of the deferment of 50% tariffs to the European Union, which suggests that there would be a positive change in trade relations.

The Dow Jones Industrial Average reached over 400 points and gained 1%, the S&P 500 was up 1.2%, and the Nasdaq Composite' growth by tech stocks was the main cause for the 1.6% rise, leading this rally.

The return marks the end of a downward trajectory for the three major indexes which on the previous week had faltered more than 2%, mainly because of the clouds over the possible EU tariffs and the cage around multinational tech giants' apple stocks. A day off from the markets was more than necessary following the Memorial Day holiday, during which the positive trade talks were digested by the investors.

Market Overview Table

Category Details TSX Index +102.6 points (+0.4%) S&P/TSX 60 +6.6 points (+0.4%) Scotiabank (BNS) +1.1% after mixed earnings (9% YoY revenue growth, EPS decline) Hudson's Bay (HUD) To cut 8,300+ jobs, close stores June 1 Dow Jones (DJI) +403.1 points (+1%) S&P 500 +71.5 points (+1.2%) Nasdaq Composite +295.8 points (+1.6%) Trade Update Trump delays 50% EU tariffs to July 9 after call with EU President Durable Goods -6.3% in April after +7.6% in March Oil Prices WTI: $60.98 (-0.9%) · Brent: $63.50 (-0.9%) Gold Prices Spot: $3,296.05/oz (-1.3%) · Futures: $3,324.46/oz (-2.1%) Upcoming NVIDIA earnings due Wednesday after market close Stocks Start Strong

Here’s a simple table showing the early gains of the major U.S. indexes at market open:

Index % Change at Open Dow Jones +0.8% S&P 500 +1.1% Nasdaq Composite +1.4% Dow Jones Industrial Average Index

The DJIA is showing signs of consolidation after a strong rebound, with the ROC suggesting weakening momentum. Traders might watch for support near 41,000 or a break below to confirm further downside.