- Check the technical outlook for the FTSE 250, and how is the UK inflation data affect its trading situation and the listed companies.

Today, the London Stock Market is expected to go up just a little bit when markets open because it went up quite a bit the day before. Investors are focusing on the latest numbers related to inflation and how prices are changing in the UK.

The inflation data released earlier showed that the prices went up more than expected in April. The UK consumer price index shows that inflation increased to 3.5% in April compared to March percentage of 2.6%. While the experts were expecting it to increase by just 3.3%.

That’s the highest reading since jan.2024.The ONS director said, “A significant increase in household bills caused inflation to climb steeply.” These increases in inflation may raise the anticipation of changing the monetary policy from easing to hawkish.

The Fundamental factor affecting the FTSE250:

Last week, the FTSE 250 had a positive outlook due the the well-performing UK economy, and the investors had good confidence in the economy, especially after the BOE cut the interest rate last month. However, the higher inflation data released today may negatively affect investors’ sentiment and raise the anticipation of the BOE fixing the interest rate in the next meeting instead of cutting it as previously expected.

Technical Outlook for The FTSE250:

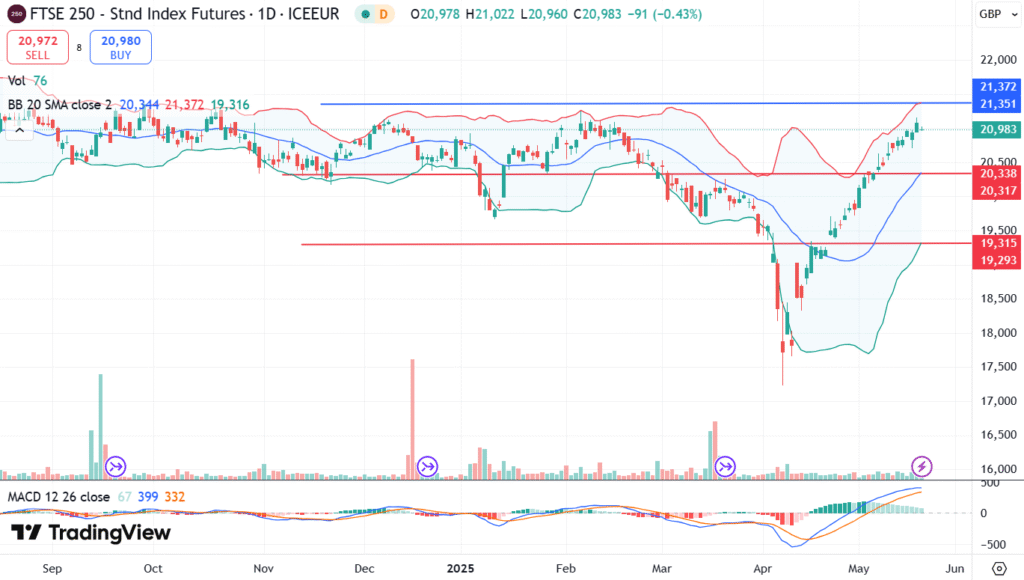

Since 22 April, the FTSE 250 has been impressively going up and positively, even the index has tested many strong resistances but successfully broke through these levels and went up. today’s the FTSE 250 is trading under a strong resistance point at 21350, any break above this level will support the bullish case. Spotlight on the FTSE 250 for its high momentum

On the flip side, if the FTSE 250 loses its rally, it will face a strong support point at 20338; any breakdown under this level may support the bearish scenario, and we may see lower levels towards 19315 and 19290.

Main index components in the news:

- British electricals retailer Currys said on Wednesday that they expect their annual profit will be higher than they previously thought. For the third time in the running year, they raise their forecast, because they are selling more, which is helping in cost coverage. In the last year, shares in Currys gained more than 70%.

- 4imprint Group expects higher product costs, supply chain distribution due to the imposed tariff on US imports from China. Their revenues for the first four months of 2025 were about the same as the same time last year

The underlying stocks are trading mixed in response to the fear of increasing costs due to the inflationary pressure, raising concerns about higher costs, which potentially impact individual companies. There might be other broader factors supporting the index.