The main factor affecting the exchange price of the GBPINR is fundamentally the United Kingdom’s gross domestic product data.

After the release of the United Kingdom GDP data, the GBP got a boost in response to the optimistic data. The government office reported that the economy grew strongly, by 0.7% in the first three months of this year, compared to the estimates of 0.6%. This indicated that the UK economy barely expanded in the last quarter of 2024.

According to the data, Year on year, the UK economy grew by 1.3% in the first quarter of this year, higher than the expectations of 1.2% but slower than the prior release of 1.5%.

Higher UK GDP means that the economy is healthier than before, which indicates that the Bank of England is less likely to cut interest rates a lot. which generally boosts the British pound.

According to India’s economic calendar, it’s mostly empty. While all eyes are on- India-Pakistan ceasefire and what’s next.

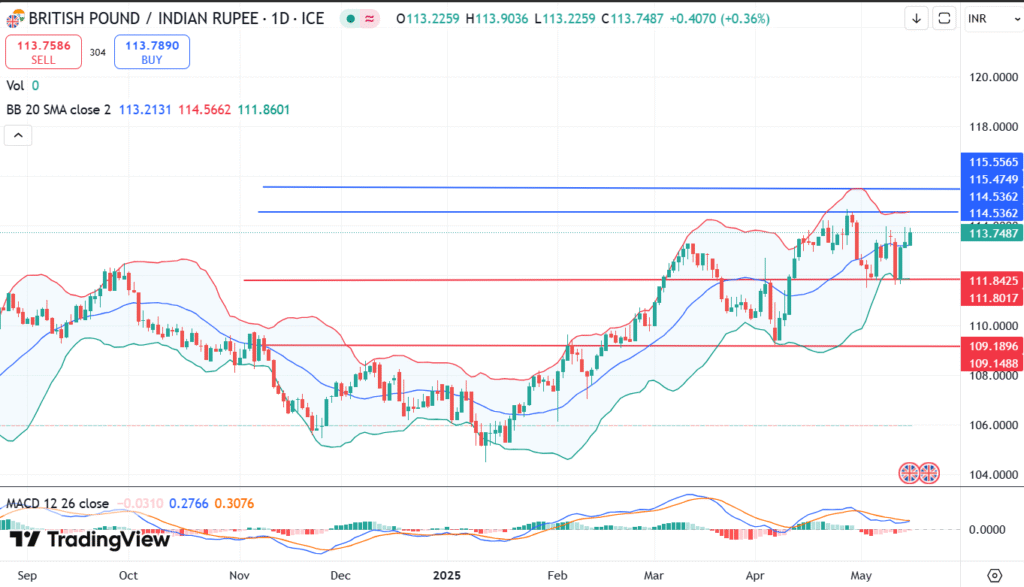

GBP / INR Technical Analysis:

GBPINR is trading now around 113.740, which is above the strong support level of 111.842 and facing resistance power coming from the 114.530 level, so any breakout above this level may confirm the bullish trend, while it needs a clear day close above this level to reach a higher level towards the 115.00 levels.

On the flip side, the GBPINR breakdown of the key support level at 111.842 could expose it to reach lower levels towards 111.00 and then 110.454.

Key events may affect the price movements:

The markets are looking for any updates related to the ceasefire deal between India and Pakistan. The US-China trade deal updates and news of upcoming Russia-Ukraine peace talks.

The monetary policy for both the Bank of England and the indian central bank; any changes to their monetary policies may affect the price movements of the pair.