- Check the EUR/USD's technical analysis amid many speeches by the central banks and how this may affect the trading price of the pair.

The EUR/USD pair has good support at 1.0945. which gives the EUR/USD the strength to keep going up and reach the 1.1200 level. The US dollar weakens against the euro after the release of the US April inflation data.

The US-CPI index measured that the change in the consumer prices declined to 2.3% YOY in April from 2.4% in March, under the market consensus of 2.4%. So the US dollar lost ground in an immediate reaction to the data.

Investors reduced their bets on European Central Bank interest cuts amid an optimistic US-China trade deal and geopolitical tensions.

EUR/USD Technical Levels:

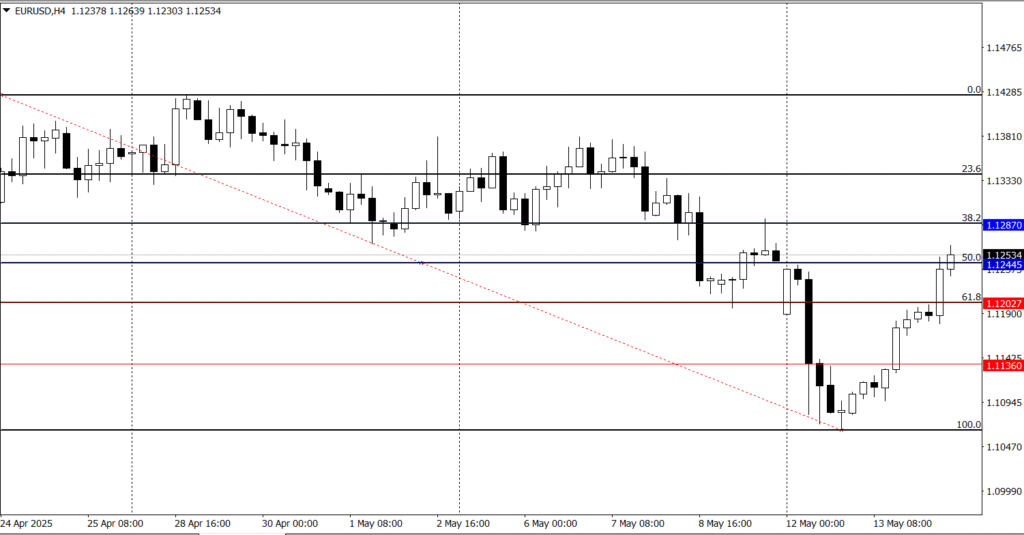

From the technical perspective, the EUR/USD successfully breaks the strong resistance of 50 degrees Fibonacci retracement at 1,12445 and is now trading around 1.1250. Any clear 4-hour close above this level could open the door for the pair to keep the bullish trend reaching 1.12870 and then 1.1300.

On the flip side, if the EUR/USD loses its ground, any breakdown under 1.0945 could end the bullish trend and bearish the pain to lower levels, reaching 1.12027. Check last week’s analysis: EURUSD Price under pressure ahead of US-China trade talks

The Main Events For Today

Today, we have an empty calendar on the data. Central bank speakers are the only highlight. So the focus will be on the central bank speakers as we try to know their next moves after the recent updates on the trade deal.

Fed’s Waller speech is the most important because he has recently been one of the most dovish members. Last month, he presented two scenarios, the first one is that the average global tariff rate would be 20%, and he would be willing to look through inflation and cut rates on a slowdown in the economy.

For the second scenario suggested, the average tariff rate would be 10%, and he would be willing to hold rates steady for longer and maintain the rate-cutting in the latter half of the year.

The second scenario is nearest to what is playing out right now. So it’s interesting to know if he will confirm this scenario or not.

Central Bank Speakers:

- BOE’s Breeden at 07:15 GMT

- Fed’s Waller at 09:15 GMT

- ECB’s Cipollone at 12:40 GMT

- Fed’s Jefferson at 13:10 GMT

- Ded’s Daly at 21:40 GMT