- The new ECB Crypto Assets Report detailing its view on USDT and UST could impact future Tether price predictions.

The collapse of the LUNA token and the UST stablecoin has turned the attention of the crypto market fully on the Tether stablecoin. This spotlight has revealed a potentially disturbing situation that could affect future Tether price predictions. The Financial Times reports that the Tether Foundation, the issuer of the USDT token, has some of its reserves stored in a non-descript bank in the Bahamas.

Capital Union is the bank in question, said to be based in Nassau, Bahamas. The bank only made its entry into the crypto market in 2022. Should traders and others who watch current Tether price predictions as the basis for their trades be worried? Maybe. It was revealed some time ago that the US Dollar did not back the USDT coin on a 1:1 basis. Indeed, some of the USDT stablecoin reserves are backed by non-fiat assets.

Some of the assets backing the peg include US government bonds (13%), cryptos and precious metals. Traders were not amused when this information leaked. Indeed, the US Commodity and Futures Trading Commission (CFTC) fined the Tether Foundation $41 million for not disclosing the actual state of its stablecoin reserves.

The latest European Central Bank (ECB) Crypto Asset Report has presented the European apex bank’s view on the Terra USD (UST) and Tether (USDT) stablecoins. The ECB says that Tether is not as stable as the name implies and that the Tether Foundation can’t guarantee the USDT peg all the time. How does this statement and market sentiment affect Tether price predictions?

Tether Price Prediction

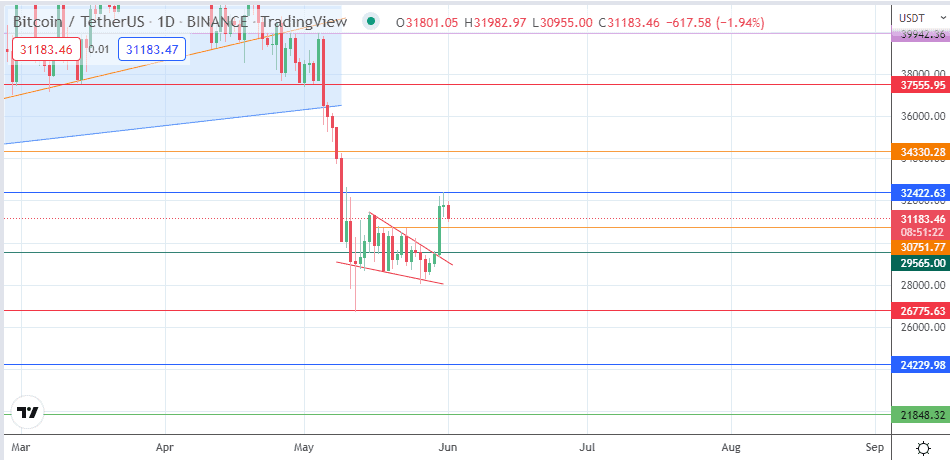

Apart from the flash spike in the BUSD/USDT pair on 12 May that sent the pair to 1.1, its highest level ever, the rate has remained stable at 1.0005 – 1.0008. The best pair to gauge strength on the Tether coin is the BTC/USDT pair. The immediate resistance remains at 32420 (10 May and 31 May highs). A break of this level weakens Tether further, targeting 34330 (9 May high). Above this level, 37555 and 39950 form additional barriers to the north.

On the flip side, a bearish close to the active daily candle that takes out the 20/23 May highs at 30750 completes the evening star pattern. This has further bearish implications and opens the door toward the 29565 support level. Below this level, 26775 forms the next target in line for Tether’s bulls.

BTC/USDT: Daily Chart