- Here is the Nvidia stock forecast for 2025 and 2026 as Chinese startup, DeepSeek offers a formidable threat to its revenue stream.

NVIDIA (NASDAQ: NVDA) has redefined the AI industry, becoming the backbone of artificial intelligence and data processing. Once known primarily for gaming GPUs, NVIDIA has evolved into the dominant force behind AI training, data centers, and high-performance computing. The company reached an astonishing milestone in June 2024, surpassing Microsoft and Apple to become the world’s largest publicly traded company with a $3.34 trillion market capitalization. However, after the historic rally, NVDA stock faced volatility, undergoing a sharp correction before stabilizing.

Notably, the company’s value doubled in the first six months of 2024, after tripling its value in 2023. The stock price registered a post-split high price of $140.76 on June 20, but declined sharply to $118.11 four days later as many investors took profit following a long bull run. However, as of this writing, NVDA has returned to the uptrend and trades at $125.24, which is about 4 percent higher than the stock split price.

The company’s stock was split after it rose past $1,200 per share, necessitating the move to make it more affordable to retail investors. The company’s AI chips have seen a spike in demand, with tech companies such as Amazon, Meta and Microsoft among its biggest customers.

February 2024, however, was the pinnacle of its success. Following a forecast-beating Q3 2023 earnings report, it saw its value rise by $272 billion in a single day. As of April 29, 2025, NVIDIA stock is trading at $108, down by 20% year-to-date. After overcoming the momentary shock triggered by Chinese startup, DeepSeek, Nvidia if currently fighting off the sour sentiment created by US-China trade tariff war.

Ultimately, however, there’s no question on whether the AI boom has reached its peak or if NVIDIA room for further gains. Tech giants like Microsoft, Apple, Meta, Oracle, Amazon and Alphabet are still forecasting substantial AI infrastructure capex, which augurs well for NVIDIA stock price. In addition, there’s little threat on the company’s dominance of the AI chips market for the foreseeable future. Nonetheless, NVDA is at a pivotal moment in its trajectory.

DeepSeek Ushers a New Era in AI?

However, a Chinese startup, DeepSeek triggered a storm in late January 2025, after revealing that it had developed a high-performance Large Language Model (LLM) codenamed, R1. The LLM is trained using substantially cheaper chips but capable of matching the performances of models developed by the likes of OpenAI, which have spent billions of dollars on high-end GPUs. This set up could potentially disrupt Nvidia’s revenue stream.

Nvidia undertook a 10-for-1 share split in June 2024, bringing down the price per share to $120. The stock currently trades at $123, about 2.5% above that level. However, that follows a sharp decline from $153.00 recorded on January 7.

In essence, Nvidia stock price has dropped by 14% in the last five days and is down by -9% year-to-date. The decline was precipitated by news that Chinese startup, DeepSeek, had made a breakthrough innovation in Large Language Model (LLM) training that have seemingly negated the need for Nvidia’s high-end AI chips.

The DeepSeek rout infamously cost a $586 billion drop in Nvidia stock price- the largest single-day loss in history. However, NVDA has bounced back since then, with its market cap is at $3.02 trillion, as of this writing making it the third most valuable company in the world behind Apple and Microsoft.

Table of contents

Nvidia Stock News

Morgan Stanley Maintains Strong Guidance on NVDA

Nvidia started shipping its high-end Blackwell processors in the third quarter of 2024, and demand had been through the roof. Investment Bank Morgan Stanley retained a buy rating for NVDA in its April 2025 release, with analyst Joseph Moore narrowly revising the target price downwards from $162 to $160. According to Moore, analysts’ assessment of a slowdown in the performance of the AI industry is “laughable”, and NVDA remains a “top pick”.

Moore attributes his downward readjustment to uncertainties in the global market and supply chain constraints in the near-term. However, he maintains that the long-term demand outlook for the company’s chips remains robust. At its current level, Nvidia stock price still has a 48% headroom, signaling a bullish outlook.

The company’s strong growth has been powered by an immense demand from the AI sector in the last two years. Particularly, the company’s Hopper GPU series have been at the centre of that growth. More recently, CEO Jensen Huang described the demand for newly launched high-end Blackwell chips as “insane.” However, the emergence of DeepSeek potentially threatens Nvidia’s revenues.

Nvidia’s AI earnings displace gaming

Nvidia’s Q4 fiscal year 2024 earnings sparked the fire that has kept NASDAQ: NVDA soaring. With sales tripling to $22.10 billion and net income soaring to $12.29 billion, Nvidia’s fourth-quarter earnings beat forecasts by far and shook Wall Street. Analysts estimate earnings above $20 billion in 2024. Nvidia projects to earn $24 billion, with a margin of plus or negative 2% in the first quarter of fiscal year 2025.

Nvidia’s strategy of developing products targeting potential tech competitors also seems to have paid off. Some of its leading clients include Meta, Google, Microsoft and Amazon; all off which are competitors in the tech innovation race.

NVIDIA’s AI-optimised GPU chips have proven irresistible across the tech space for training of Large Language Models and development of generative AI. These are central to the development of AI solutions, and the tech giants have been spending billions of dollars to acquire the GPUs from NVIDIA.

Microsoft spent approximately $31 billion on acquisition of Nvidia GPU chips in 2024. Meanwhile, Meta plans to spend $65 billion on AI-related capex in 2025. NVIDIA’s high-capacity GPUs are at the forefront of the race to develop artificial general intelligence (AGI), which is touted as being potentially capable of being more intelligent than humans.

DeepSeek AI Effects on NVIDIA Stock

One of the latest developments shaking up the AI industry in the first quota of 2025 is the emergence of DeepSeek AI, a powerful open-source AI model designed to compete with OpenAI’s GPT-4 and Google’s Gemini models. DeepSeek AI has demonstrated significant efficiency improvements, reducing the energy and computational power needed for AI model training.

This could have mixed effects on NVIDIA. On the one hand, demand for NVIDIA’s AI chips might soften if companies shift toward energy-efficient AI solutions. On the other hand, DeepSeek’s advancements could lead to even more AI development, increasing the need for NVIDIA’s high-performance computing solutions.

NVIDIA’s next-generation Blackwell GB200 chips are expected to counteract any competitive pressure by delivering even faster processing speeds with lower energy consumption. However, the long-term impact of AI efficiency improvements on chip demand remains uncertain.

Nvidia announced Blackwell in March 2024, a new line of AI-focused processor chips. The first out of this product line, the GB200, has a capacity of 20 petaflops. That is a massive upgrade from the previous 4 petaflops for the highly-successful H100 chips. Nvidia started shipping the GB200 from the fourth quarter of 2024. The Blackwell family of processors is miles ahead of the competition. Furthermore, the H100 chips are still in high demand.

Will Nvidia Stock Go Up?

The question should not be, “will Nvidia go up”? Instead, the question should be about the extent to which Nvidia should be going up. This is a stock that has a lot of tailwinds following it. Nvidia’s success in the AI field is likely to keep it in the lead for longer, much as the stock price is currently down.

That said, the demand for these chips could be impacted by DeepSeek’s inroads. Nonetheless, breakthroughs in AI technologies, products and services could create a strong demand. Conversely, a stagnation in AI development could impact Nvidia’s earnings.

In the short-term, the NVDA stock price is likely to continue until the stock split happens on June 7. However, in the coming months, it could ease as investors take profits. Furthermore, higher-for-longer US interest rates could create a harsh environment that could limit the upside.

Also, supply patterns in the global semiconductor market could weigh on the market. For instance, in 2024, Super Micro Computers (SMCI) and Advanced Micro Devices Inc (AMD) encountered headwinds in that front. A repeat of the same in 2025 could potentially affect the broader market and, by extension, NVIDIA’s ability to meet order volumes amidst an AI market boom.

Nvidia Stock Forecast 2025

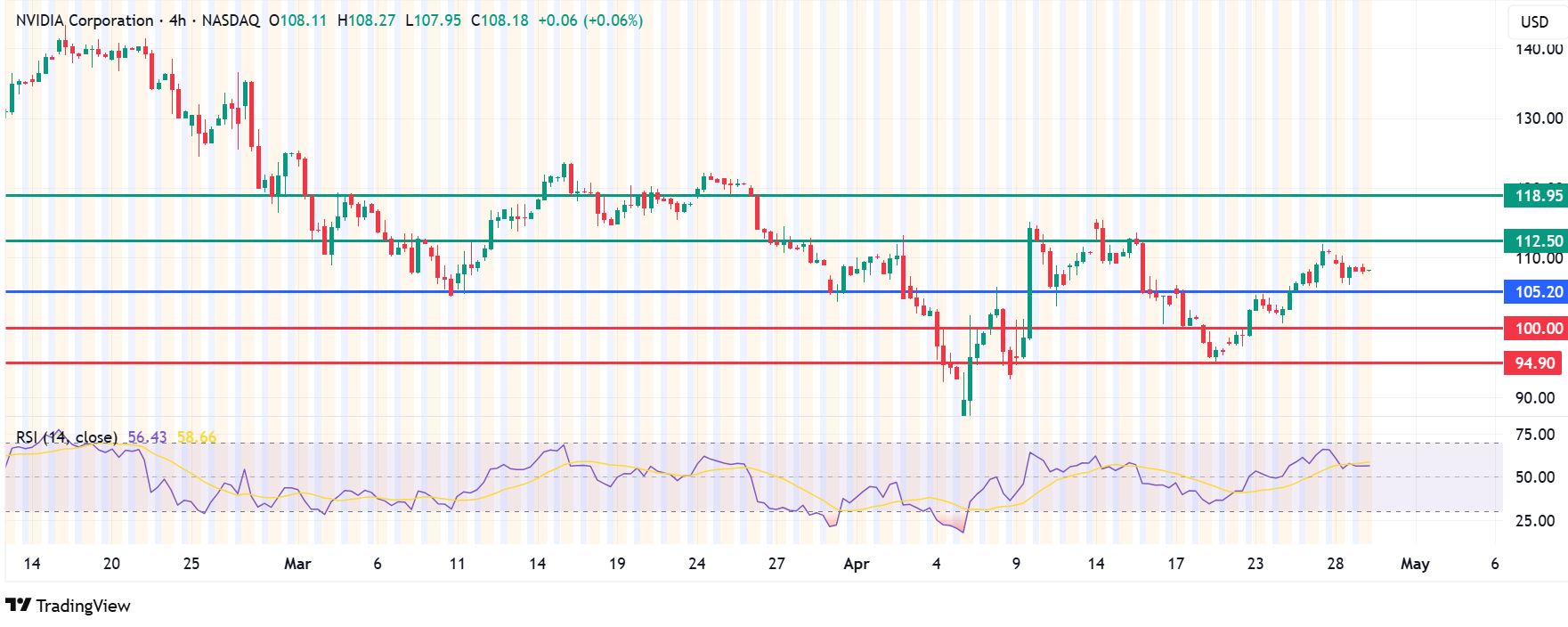

Nvidia Weekly Outlook: Tariff Fears Weigh on NVDA as It Battles Key Resistance

Nvidia Price Today: $115.62

1-Week Performance: -15%

Today’s Move: +3%

Nvidia stock (NVDA) is struggling to recover from a sharp sell-off last week, sparked by renewed global tension over potential U.S.-China trade tariffs. The chipmaker, deeply tied to the semiconductor supply chain, remains vulnerable to macroeconomic shifts and trade policy. This week’s 3% rebound offers short-term relief, but NVDA must clear multiple resistance levels to regain bullish momentum.

Chart Analysis: Key Support and Resistance Levels

- Immediate Resistance: $112.20 – A breakout above this level could trigger a bullish push toward $118.95.

- Immediate Support: $100 – Currently holding. Losing this zone may weaken the short-term bullish setup.

- Major Support: $94.90 A breakdown here could lead to a deeper correction toward the 2024 lows.

Nvidia: Price Chart to Stock Split

As described earlier, Nvidia stock price rally will likely continue at least until the share split. The stock is currently on a bull run. Based on the 10-to-1 ratio of the split, I have placed the lower end of the price target forecast in 2024 at $96, while the top end is $120.

The technical analysis shows that on Nvidia stock price currently trades below the Volume Weighted Moving Average (VWMA) on the weekly chart. The VWMA reading is at $133.65, and that mark will likely be the ceiling in the medium-term. Furthermore, the pivot mark will likely be at $120, the post-split listing price. However, a move below that mark will signal control by the sellers, but I expect support to be at $100, near the neckline of the would-be double-top pattern.

On the upside, a break above the VWMA level will signal control by the buyers. Beyond that point, the next barrier is likely to be at $152.38, which correponds to the upper Bollinger Band level on the weekly chart. However, an extended control by the buyers could potentially test the next psychological target at $160.00.

Why is Nvidia Bouncing Back?

Nvidia broke to lows of $95 in the third week of April, but is bouncing back as dip buyers step in, viewing the 15% drop as an oversold opportunity. Despite recent volatility, AI-driven demand remains strong, with data center expansion and machine learning adoption fueling long-term growth.

Institutional investors continue to bet on Nvidia’s leadership in the AI chip market, seeing it as a cornerstone of the AI revolution. Additionally, broader market stabilization, with stock futures turning green and Treasury yields easing, has lifted sentiment across tech stocks, helping Nvidia regain ground.

Nvidia Stock Forecast 2026

The Nvidia stock forecast 2026 outlook carries on from the 2025 outlook, and will likely head up, as I expect the company to withstand the DeepSeek onslaught.Therefore, my Nvidia stock forecast for 2026 remains bullish. However, there is a chance that the price may retreat as a result of profit taking after the stock split.

Tariff Risks and Macro Outlook

Rising concerns over potential tariffs on Chinese technology imports are putting Nvidia in the spotlight. As a major player in GPU and AI chip production, any disruption in global trade routes or cost escalation could severely impact its margins and forward guidance. Investors are now closely watching Washington and Beijing for any signs of escalation.

Nvidia Stock Outlook

Unless Nvidia decisively breaks above $112 and retests the psychological $120, its technical outlook remains neutral to bearish. A close below $100 would shift the bias further downward. For now, the stock is caught in a macro-driven squeeze between tariff fears and oversold technicals.

Is Nvidia a Good Stock to Buy?

Nvidia is a good stock to buy. It has good cash flow, solid fundamentals, and has the support of 42 institutional firms as a “Strong Buy”. However, as mentioned above, its growth is critically hinged on the success of the AI sector as a whole. Whether or not it is an excellent stock to buy at the current price is another matter entirely.

Summary

Nvidia stock forecast for 2025 and 2026 is still bullish, despite the emergence of a formidable challenge in DeepSeek. The company has been able to ride a wave of success from the pandemic and the global demand for high-performance AI GPUs is unlikely to slow down. However, the DeepSeek phenomenon could eat into part of Nvidia’s revenue stream.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.