- Crude oil price has extended the week's losses amid concerns that supply growth in the coming year may exceed demand growth rate.

Crude oil price has extended the week’s losses amid concerns that supply may exceed demand in the coming year. Granted, Omicron is expected to have a lesser impact on mobility and overall oil demand compared to the prior coronavirus variants. However, as indicated by the International Energy Agency (IEA) on Tuesday, the rising COVID-19 cases will likely dent fuel demand at a time when oil output is set to rise.

The outlook is different from that OPEC+. On Monday, the alliance raised its demand forecast for Q1’22 by 1.1 million bpd. Notably, the divergent expectations have heightened volatility in the oil market.

Crude oil price prediction

Brent oil has eased at around 73.00 after extending the week’s losses in the previous session. At the time of writing, it was down by 0.44% at 72.92.

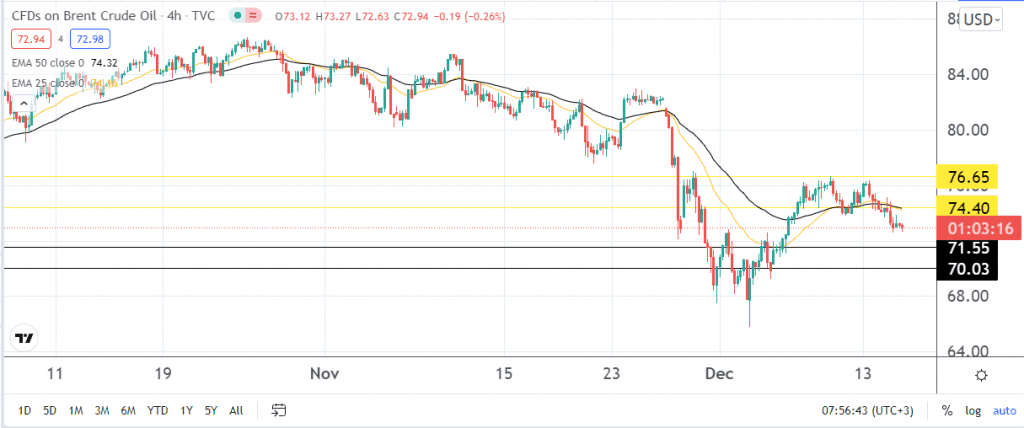

On a four-hour chart, it is trading below the 25 and 50-day exponential moving averages. Besides, the formation of a double top pattern along the resistance level of 76.65 indicates that crude oil price may remain volatile in the immediate term.

It may continue to hover around 73.00 as investors await EIA’s weekly inventory data later in Wednesday’s session. Bullish figures will likely have Brent experience resistance along the 50-day EMA at 74.40. Above that level, the bulls will have an opportunity to retest the month’s high at 76.65. However, they will need to gather enough momentum to break the resistance at 75.00.

On the flip side, bearish numbers may place the support level at 71.55. with further decline, the psychological zone of 70.00 will be one to look out for.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.