- Analysts at Goldman Sachs believe that the HSBC share price will rebound by about 40%. We explain why this is possible.

The HSBC share price has done well in the past few weeks as worries over Evergrande have receded and the economic recovery has continued. The stock is trading at 439.60 in London, which is about 33% above the lowest level at the height of the Evergrande crisis. It remains about 5% below the highest level this year.

Banking risks ease

The HSBC stock price crashed hard in September as investors worried about its exposure in China’s property market. At the time, the risk was that Evergrande, the second-biggest real estate company in the country would go bankrupt. Subsequently, that would have led to systemic risks that would affect companies with an exposure to the sector.

Evergrande has not yet gone bankrupt. Instead, it has continued honoring its bond commitments. Indeed, today, the company announced that it raised more than $273 million by selling its stake in the HengTen video streaming site. By selling the stock, the company announced that it incurred a loss of more than HK$8.5 billion.

The HSBC share price has also done well even as Hong Kong’s businesses continue to struggle. This has happened as the government has embraced the Covid-0 strategy that has led to substantial disruptions. Earlier this week, the city was criticized by letting Jamie Dimon in. Jamie is the CEO of JP Morgan.

Meanwhile, hopes that the Bank of England (BOE) will start turning hawkish has also pushed the stock higher. This happened after the UK published a streak of good economic data. For example, the country’s inflation rate surged to the highest level in more than a decade while the unemployment rate has declined sharply.

Analysts believe that the HSBC share price can soar to about 480p, which is about 10% above the current level. Goldman Sachs analysts are the most bullish since they believe that the shares will jump by 40% to more than 600p.

HSBC share price forecast

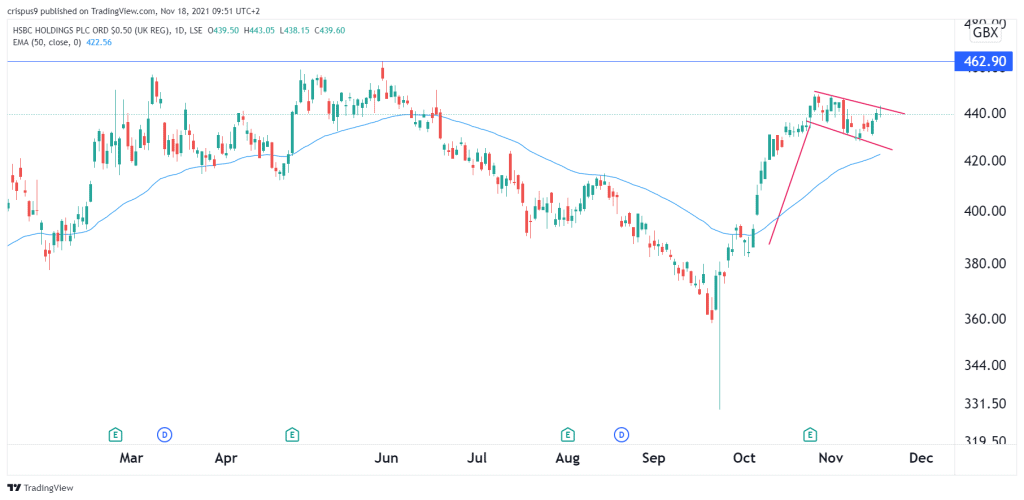

On the daily chart, we see that the HSBC share price has been in a strong bullish trend in the past few weeks. The stock has also formed a bullish flag pattern that is shown in red. It is also above the important 50-day moving average. Notably, it has formed a V-shaped recovery, which is usually a bullish sign.

Therefore, because of the bullish flag pattern, there is a likelihood that the stock will have a bullish breakout in the near term. This will likely see the shares rising to the year-to-date high of 462p.