- Goldman Sachs makes a crude oil price prediction of $110 per barrel as demand pressures outstrip supply and inventories.

- Crude oil hits 7-year highs as demand far outstrips supply

- Colder, early-onset winter, global economic recovery and gas-to-oil switch pushing demand.

- Goldman Sachs sets $110 crude oil price target.

Crude oil price is trading at highs not seen since 2014, as surging demand continues to outpace supply, even as the global economy continues on the path to recovery from the pandemic lows. Also driving up demand for crude oil is the switch from natural and gas and coal to crude oil derivatives as alternative fuel sources, amid soaring prices of these commodities in Asia and Europe. A lack of adequate clean energy supplies from alternative weather patterns is also contributing to the situation.

Monday’s price surge came after Goldman Sachs raised its demand outlook, stating that it expects demand to recover to pre-pandemic demand levels of 100 million barrels per day. The bank says that switching from natural gas and coal will contribute to demand and suppress inventories well into 2022. Goldman Sachs has set a price peak target of $110 per barrel before demand starts to drop off.

Recall that OPEC Secretary-General Mohammed Barkindo had predicted a rise in demand for crude oil in the 2nd half of 2021. Brent crude is trading at $86.08 as of writing, up 0.1%.

Crude Oil Price Outlook

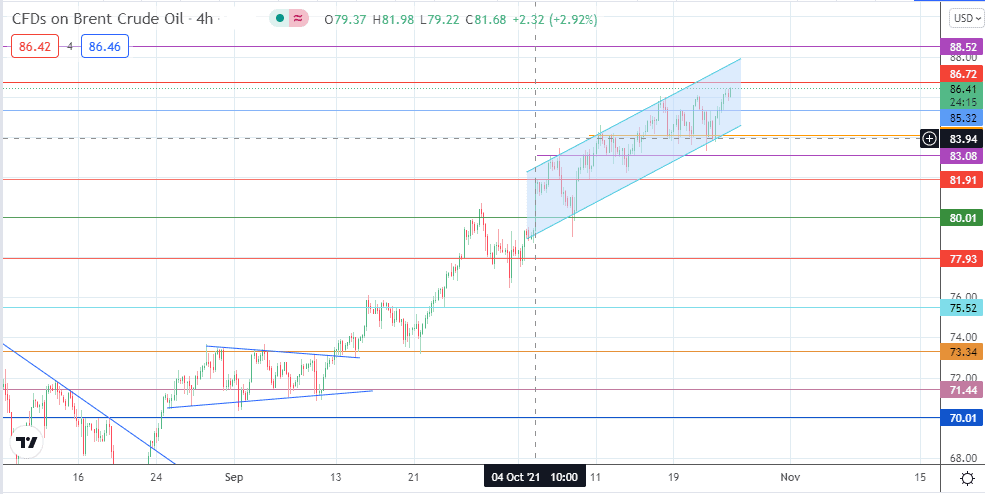

The crude oil price outlook on the 4-hour chart shows the price action aiming for the 86.72 resistance. This move is occurring following traction gained from a bounce on the ascending channel’s trendline. If the bulls take out this 7-year high, 88.52 and 91.32 become the additional price targets to the north. The latter is the site of previous highs last seen on 29 September 2014.

On the flip side, rejection at 86.72 could trigger a pullback which will challenge support at 85.32. A break of this support allows for a price dip towards the channel’s trendline. 83.08 and 81.91 are immediate downside targets that follow a corrective decline below the channel, with 80.01 also coming into the picture if the decline is extensive.

Crude Oil Price (Brent): 4-Hour Chart

Follow Eno on Twitter.