- Brent crude oil price is rising today. Here are the five reasons or factors moving the commodity this week, including falling US inventories.

Crude oil price is up for the second consecutive day as traders refocused on the US hurricane season that is expected to disrupt US supply. Brent crude is up by more than 1.50% while West Texas Intermediate (WTI) is up by 1.80%. The price is rising even after OPEC and IEA warned about demand. It is also rising after data showed that US inventories slumped in the previous week.

Several things are driving crude oil prices this week. First, on Monday, OPEC released its monthly report in which it forecasted that oil demand will fall by more than 9.5 million barrels per day this year. This will represent a 9.5% decline from 2019. And yesterday, the France-based International Energy Agency (IEA) said that demand will fall by 8.4 million barrels per day this year.

Second, the hurricane season in the US has arrived, leading to supply disruptions. According to the Wall Street Journal, 27% of oil production at the Gulf of Mexico was halted because of the upcoming Hurricane Sally. The hurricane is expected to make landfall in Alabama today.

Third, crude oil price is also reacting to relatively supportive inventories data. In a report yesterday, the American Petroleum Institute (API) said that inventories in the United States declined by more than 9.5 million barrels last week. That was a surprise figure considering that the median forecast by analysts was an increase of more than 2 million barrels.

Last week, the data showed that the inventories rose by more than 2.9 million barrels. Later today, the Energy Information Administration (EIA) will release its data and analysts expect the inventories to rise by more than 1 million barrels.

Fourth, crude oil price is responding to the recent decisions by Saudi Arabia to cut prices for its deliveries in parts of Asia. Iraq has also slashed prices and analysts expect other countries to do so.

Finally, the price of crude oil is reacting to a relatively strong economic situation. Early this week, data from China showed that the economy continued to do well, with retail sales and industrial production improving. And early today, the Chinese government approved more than $13 billion of fixed asset investments this month.

Brent Crude oil price forecast

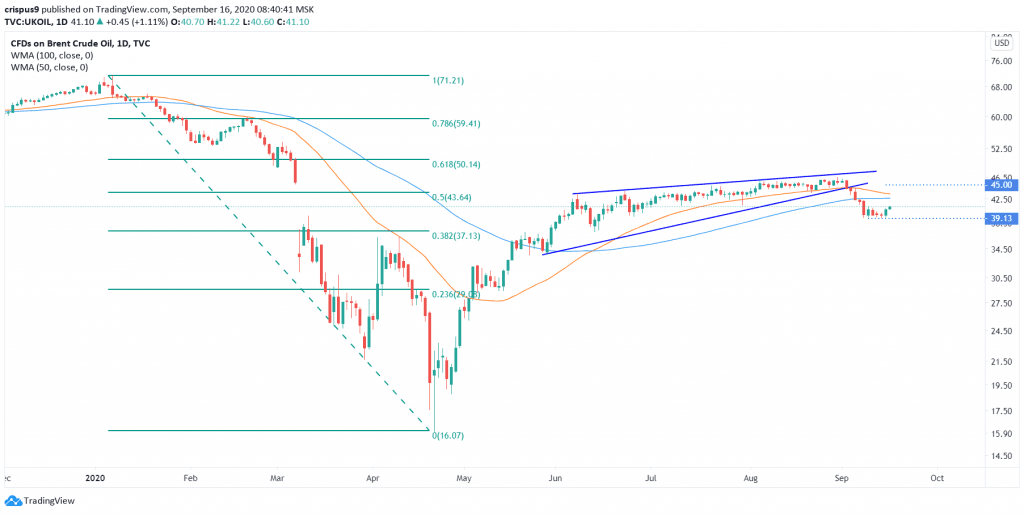

The daily chart below shows a few things about Brent crude oil price. First, we see that the price reached a low of $15.70 at the height of the coronavirus pandemic. It then rose and reached a high of $45 in August. Also, we see that the price formed a rising wedge pattern that is shown in blue. The price is also below the 50-day and 100-day weighted moving average. It is also between the 50% and 38.2% Fibonacci retracement level.

Finally, we see that the price found some support at the $39.13 level this week. Therefore, I suspect that the price will continue rising as bulls aim for the next resistance at $45. However, a move below the support at $39.13 will invalidate this trend.

Crude oil technical chart