- The EURUSD pair ignored the upbeat manufacturing PMI numbers from the eurozone because investors are still focusing on upcoming US nonfarm payrolls data

The EURUSD pair is little changed today as traders reflect on the upbeat manufacturing PMIs from Europe and the better-than-expected unemployment numbers from Japan. The pair is trading at 1.1242m which is higher than the intraday low of 1.1217.

Eurozone manufacturing sector upbeat

The world economy is bouncing back as more countries move to reopen their economies. That is the feeling you get when you look at the manufacturing PMI numbers released by Markit today. Earlier today, we received upbeat data from Australia and China.

And just in, data from Europe shows that the economy is recovering. According to Markit, the French manufacturing PMI rose to 52.3 while that of Italy rose from the previous 45.4 to 47.5. In Germany, the eurozone’s powerhouse, the PMI rose to 45.2 from the previous 36.6. Sure, for Germany and Italy, the PMI is still in contraction zone but it still made some progress. In the eurozone, the PMI rose to 47.4 from the previous 39.4.

In the accompanying statement, Markit said that the eurozone’s PMI has been below 50.0 for the past 17 successive months. It also found some divergencies across several indices of the PMI. For example, the intermediate and investment goods continued to rise while a return to growth among consumer goods rose. In a statement, Chris Williamson of Markit said:

“Expectations for the year ahead have also rebounded sharply as hopes grow that the economy will continue to find its feet again in the coming months.”

EURUSD waits for nonfarm payrolls data

There are three simple reasons why the EURUSD is unfazed by the upbeat manufacturing data. First, the numbers from the United States are expected to be good also. Second, the pair is waiting for the US nonfarm payrolls numbers. The official numbers will come out tomorrow, not the usual Friday. That is because the US will be in holiday on Friday.

Analysts expect the numbers to show that the economy added more than 3 million in June as the unemployment rate declined to 12%. Third, the pair, which is also the most liquid, is reacting to a statement by Jerome Powell yesterday. In the statement, the chair said that the economy remained fragile and that a second wave would cause untold suffering to the economy. He said:

“When the economy reopens – remember, we sort of deliberately closed the economy – that expansion can be vigorous and strong, and it’s just beginning now.”

EURUSD technical analysis

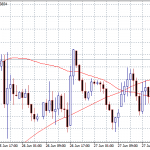

The daily chart shows that the EURUSD pair is above the 50-day and 100-day exponential moving averages. The price is also forming a triangle pattern that is shown in black. It is also below the 78.6% Fibonacci retracement level. Therefore, with the pair forming a bullish pennant pattern, there is a possibility that it will break out upwards.

If it does, it is likely to test the important support at 1.1420. On the flip side, a move below the important support at 1.1173 will invalidate this prediction. This price is the lowest the pair has been since June 13.