USDJPY is giving up 0.09 percent at 107.68 ahead of the G20 meeting in Osaka, Japan. Earlier today the report on Japanese Housing Starts, Year on Year, came in at -8.7% worst than analyst’s forecasts of -4.3% for May. Macro data from USA yesterday failed to impress USD investors The Personal Consumption Expenditures Prices reported at 0.5% on a quarterly basis for first quarter better than analysts’ forecast. The initial Jobless Claims came in at 227,000 beating analyst’s estimates of 220,000 for June 21. The US Dollar price dynamics will continue to drive the pair’s momentum and today USD is weaker across all majors.

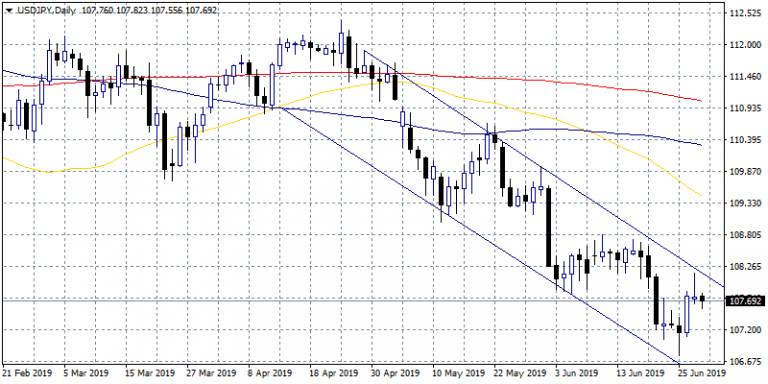

USDJPY rejected yesterday from 108.13 the upper of the downtrend channel and sellers stepped in to push the pair below the 108 mark. Today the pair started from 107.80 to hit the daily low at 107.55. Immediate support for the pair stands at 107.50 THE 100 hour moving average while extra support will be met at 107 round figure. On the upside first resistance stands at 108 psychological level and then at 108.13 downtrend line while a break above can drive prices up to 108.96 the high from May 31st. The Bearish momentum for USD against Yen is still intact and any strong upticks for the pair should considered as selling opportunity.Don’t miss a beat! Follow us on Twitter.