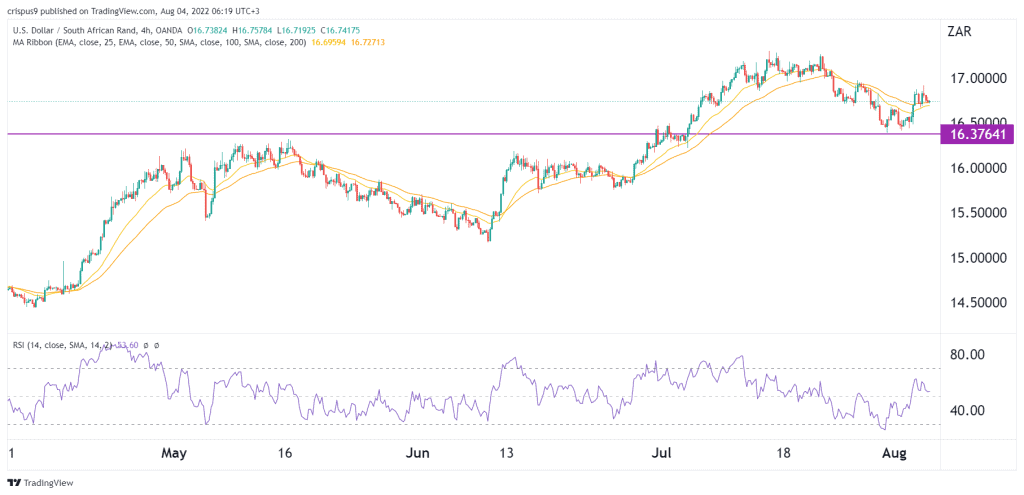

The USD/ZAR price moved sideways on Thursday as investors refocused on the upcoming US non-farm payrolls (NFP) data set for Friday. The USD to rand exchange rate was trading at 16.74 on Thursday morning, which was slightly higher than last month’s low of 16.37. This price is about 3.26% below the highest point this year.

US NFP ahead

The USD to South African rand price rose slightly this week after a series of important hawkish statements by several Federal Reserve officials. Charles Evans and Lorretta Meister warned investors that they were getting overly excited about the next actions by the Fed.

After hiking by 0.75% last week, the US published weak GDP numbers. As a result, most analysts predicted that the Federal Reserve will slow down its rate hike policies in a bid to lower inflation. As a result, US bond yields have all retreated, with the 10-year currently sitting at 2.5%, which is lower than where it was this year.

The next key catalyst for the USD/ZAR price will be the upcoming US non-farm payroll data scheduled for Friday. Economists expect these numbers to show that the country’s unemployment rate remind unchanged at 3.6% in July.

At the same time, they believe that the nonfarm payrolls rose by just 250k, which will be lower than the previous increase of 381k. These numbers are notable since they will provide more signals about the next actions by the Federal Reserve.

USD/ZAR forecast

The four-hour chart shows that the USD to ZAR exchange rate dropped to a low of 16.37 last week. This was a notable level since it was the highest point in May this year. It then bounced back and reached a high of 16.92. The pair is now oscillating around the important 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved slightly above the neutral point.

I suspect that the pair will keep rising as bulls target last month’s high of 17.30. A drop below the support at 16.37 will invalidate the bullish view.