USDJPY

In this section, you will find important USDJPY news, actionable trading ideas, and a live USDJPY chart to help you understand the markets better.

USDJPY is the ticker symbol in Global FX markets that represents how many Japanese Yen you can buy with one US dollar. USDJPY is one of the world’s major currency pairs according to the Bank for International Settlements and represents 17% percent of total daily volume on forex trading markets. The factors that affect the value of the pair are the economic policy by the Japanese and U.S. governments and central banks, but also economic conditions and other economic indicators like unemployment, imports, exports, etc. However, a key driver is risk sentiment and there is a good negative correlation between stock markets and the Japanese Yen in the short term. The JPY is sensitive to risk sentiment as it is a so-called funding currency. The pair is very popular among traders because of the high liquidity and tight spreads.

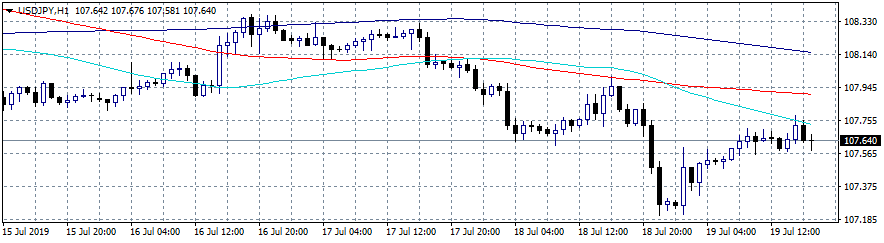

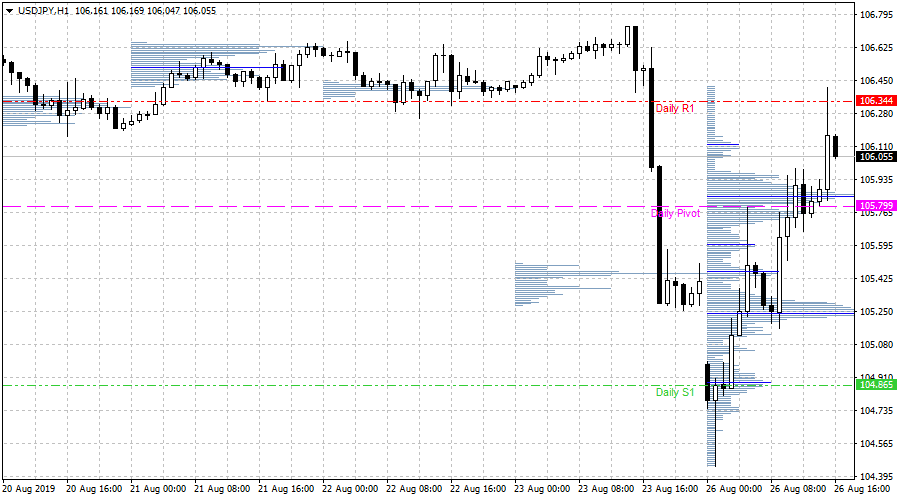

Live USDJPY Chart

AUDUSD Chart by TradingView