The Terra price has been on a tear over the last 6 weeks, jumping more than 500%. However, recently, the LUNA coin is starting to look vulnerable. It’s not so much that the price is falling away, but the choppy price action between $26.00 and $38.00 is indicative of an undecided market. And in my experience, this could lead to either an exaggerated upside extension or a material reversal.

Terra (LUNA/USD) has undoubtedly been one of the best performing top-rated cryptos recently. After trading to a low of $5.52 in July, the LUNA price embarked on an impressive bull run. A 6-week buying spree saw LUNA increase in value by 600% to set a new record of $37.64 on the 29th of August. However, since then, despite the broader market tracking higher, the price has failed to advance and is last at $32.00. Nonetheless, the stellar performance has lifted Terra’s market cap to almost $13 billion, ranking it the 15th-largest cryptocurrency behind Bitcoin cash (BCH/USD). However, looking down my watchlist, one thing is concerning. Of the top-50 coins, only LUNA has a negative 7-day performance. This could spell trouble for the bulls.

LUNA Price Forecast

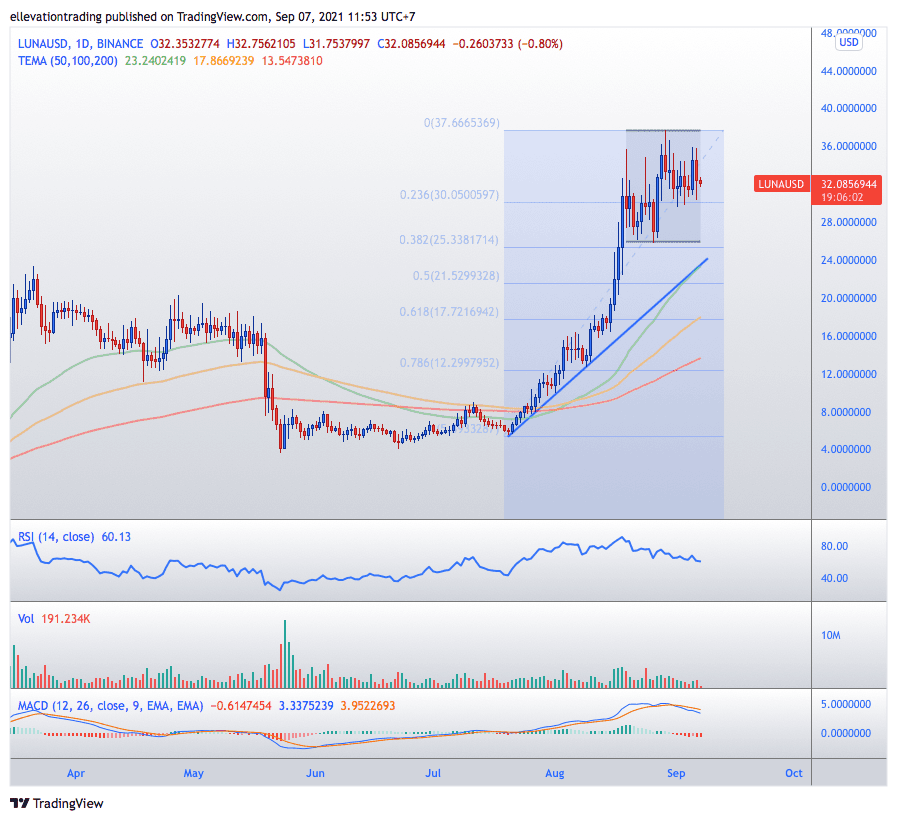

The daily chart shows the scale of the Terra price appreciation in the last two months. Although impressive, some negative factors are emerging. Firstly, the trading volume is incredibly light and not indicative of large-scale buying. This suggests the rally has been retail-driven, making it vulnerable to forced liquidation if the price starts to lower.

Furthermore, momentum indicators are also starting to roll over. The Moving Average Convergence Divergence Indicator (MACD) is in negative territory, highlighting a sentiment change.

Notwithstanding a break above the high, LUNA should trade back to the recent support at around $25.80. This sits just above the 0.382 Fibonacci retracement level of the recent rally. Additionally, trend line support and the 50-day moving average converge at $24.00 to lend to the price support.

In saying that, if the Terra price fails to sustain $24.00, it will test the resolve of recent buyers. This is likely to illicit stop-loss selling, which could result in a steep decline. In that event, the 100-day moving average at $17.86 and the 0.618 Fibonacci at $17.72 are obvious targets.

However, if the bulls can penetrate the previous high, an extension into unchartered territory looks likely. Therefore, the bearish view is only valid as long as the Terra price remains below $37.64.

Terra Price Chart (Daily)

For more market insights, follow Elliott on Twitter.