Stock market futures on the S&P 500 index are pointing to a higher open for the index following Tuesday’s modest decline. The S&P 500 index futures are up 10 points. However, the uptick could face some early pressure as geopolitical tensions between China and Taiwan could spur cautious trading.

US House Speaker Nancy Pelosi touched down in Taiwan and met with the territory’s leaders, pledging continued US support. On the other hand, Beijing has described the visit by Pelosi as an act of provocation and has deployed a heavy military presence around Taiwan in response. Escalation of the situation could promote risk aversion, keeping traders cautious.

Recent comments by St.Louis Fed President James Bullard and several other regional Fed bank heads drove up expectations that the Fed would continue to pursue aggressive rate hikes. These comments drove up US 10-year bond yields by 6.73%, driving investment flows from the S&P 500 index and other US indices to the bond markets. These all culminated to push the index lower by 27.44 points or 0.67%.

Fundamental triggers for the rest of the week include the ISM Services PMI data, Factory Orders and Friday’s Non-Farm Payrolls report. Traders on the S&P 500 index may also have an eye on next week’s consumer price index data. If the CPI continues to show a higher print, this could add to Tuesday’s hawkish Fedspeak to rile up aggressive rate hike expectations, potentially dampening the recovery of the S&P 500.

S&P 500 Index Forecast

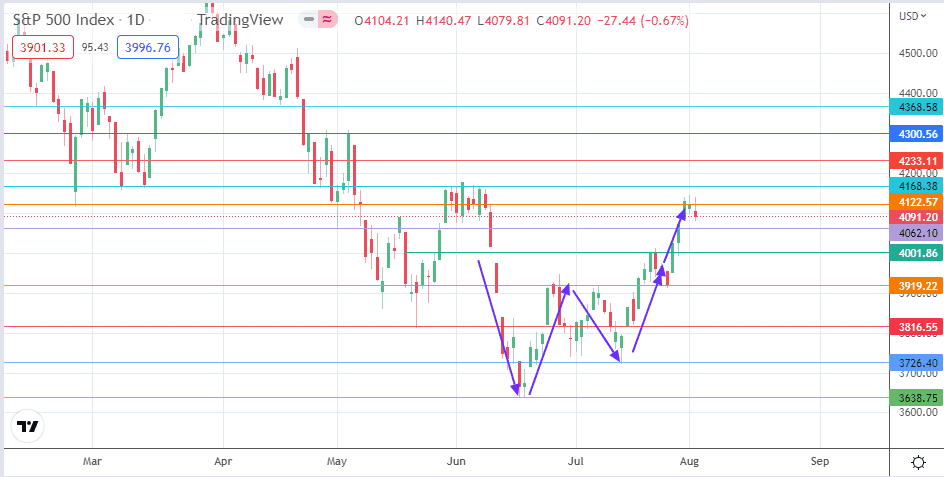

The W pattern’s recovery appears to have stalled with the formation of two pinbar candles at the 4122 resistance level (24 February low and 9 June high). If the bears seize on this to drive a pullback move, the next target in line comes in at 4062. The 4000 psychological price mark (25 May and 21 July highs) comes into the picture as the next target in line following further price deterioration before 3919 (8 July high and 26 July low) and the 28 June/15 July lows at 3816 line up as additional downside pivots.

A breakout from the 4122 resistance barrier negates the bearish outlook. This move clears the path toward 4168 (27 April low and 6 June high), with 4233 (27 April high) and the psychological resistance at 4300 lining up as potential upside targets.

SP500: Daily Chart