- Silver Price Prediction: In this article, we present to you the XAG/USD forecasts for 2026, 2030, 2040 and beyond

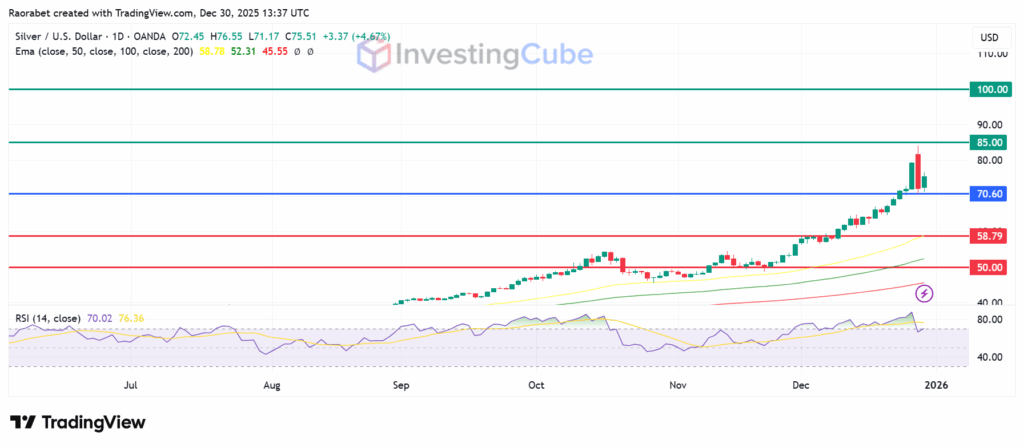

Silver has extended its powerful 2025 rally, climbing from the mid-30s in early summer to trade at an all-time high near $85 per ounce on December 29. The uptrend accelerated sharply from mid-June, when prices hovered around $37, and continued through September’s breakout above $40 before pushing decisively into the $50s. This surge now places silver at its highest level in over a decade, reflecting a mix of strong macro demand, safe-haven inflows, and tightening supply dynamics.

After a choppy start to the year that saw silver briefly dip toward $26, the market has since reversed sharply, turning 2025 into one of its strongest periods in recent memory. Momentum picked up as industrial demand steadied and safe-haven interest returned, lifting year-to-date gains to roughly 45 percent and putting silver ahead of gold’s performance.

With prices now pressing towards the $90 mark, traders are watching closely to see whether this latest leg higher has enough conviction to carry the metal into triple-digit figures.

This article was originally published in 2023 and is frequently updated to reflect the latest silver price action and technical analysis.

What Is Silver?

Silver belongs to a category of metals considered very precious due to its wide range of uses and its preference as a store of value. Human civilizations have used Gold and Silver as primary means to exchange and store value for thousands of years. Furthermore, silver is used in several industrial processes. As a result, the price of silver has always remained tied to economic activity worldwide.

The XAG/USD tracks the price of Silver in terms of the United States dollar. Therefore, the pair generally shows an inverse correlation to the strength or weakness of the greenback.

Silver Price (XAG/USD) Latest News and Market Developments

The Silver Institute’s World Silver Survey and Metals Focus Silver report that silver saw its fifth year of shortage in 2025. The silver in London and Shanghai hit nearly a decade low. The rise of AI and green tech pushed industrial demand past 700 million ounces for the first time. Building AI data centers and installing lots of solar panels turned silver into a key resource, not just a metal.

Mine production went up 2% to a seven-year high of 844 million ounces. Still, the market had its fifth shortage, which the Silver Institute estimates at about 200 million ounces. Global demand went down 4% to 1.12 billion ounces, but industrial use hit records because of AI and the move to green energy, plus solar and electronics. Yahoo Finance mentioned this. Supply stayed tight, traditional sources made less, and sanctions caused problems, making the shortages worse.

Silver Price 2025 Roundup

Silver had a record year in 2025, outperforming gold with its best showing since 1979. Starting around $30, silver prices climbed throughout the summer, breaking past resistance to reach $75–$84 by the end of December. This 165% rally happened because of high industrial demand and strong investor interest.

As gold crossed the historic $3,000 threshold early in the year, investors pivoted to silver, which was seen as significantly undervalued. The gold-to-silver ratio dropped from about 90:1 in 2024 to roughly 62:1 by the end of the year 2025. The Federal Reserve’s late-year interest rate cuts made holding non-yielding assets more attractive, pushing prices higher in December.

Why Silver Prices Are Surging Toward Multi-Year Highs

Silver’s latest rally is being driven by a combination of tightening supply and accelerating industrial demand. The global market has been running a structural deficit for several years, with consumption repeatedly outpacing what miners and recyclers can deliver. This imbalance is now reaching a pressure point, forcing major exchanges to draw down inventories at the fastest pace seen in more than a decade.

Unlike gold, silver sits at the intersection of precious-metal demand and industrial usage, giving it two major engines of growth. That dual nature is helping amplify the current breakout, especially as broader macro themes continue to favor hard assets.

Silver Demand Outlook: How Solar and EV Growth Are Driving Prices

A key pillar behind silver’s strength is the surge in industrial consumption. Solar panel manufacturers, electric-vehicle producers, semiconductor firms, and 5G network developers continue to expand capacity, all of which require significant amounts of silver due to its unmatched conductivity.

This demand is structural, not cyclical. Even if broader economic activity slows, long-term commitments to renewable energy, grid upgrades, and electrification remain intact. That is why silver has outperformed gold this year, with industrial buyers absorbing dips faster than in previous cycles.

Silver Price 2026 Outlook

There are risks to consider, such as a stronger U.S. dollar driven by changes in U.S. policy or lower deficits if we increase production. The Economic Times has reported possible price targets of $2.8–$3.2 per kilogram (roughly $87–$100 per ounce) by the end of the year, but that depends on current trends continuing.

The shift towards sustainability means the market is now valuing consistent performance and stability over rapid, short-term gains. This is partly a response to previous periods of high volatility and uncertainty. The retail sector’s optimism is fueled by increasing consumer interest and investment in certain areas. However, major banks usually conduct deeper analyses, taking into account various economic indicators and global factors that could influence prices.

Silver Price Technical Levels to Watch in 2026

The 50-day EMA is rising fast and is acting as a medium-term support around $58.79. The 200-day EMA is way down at $45.45, which shows the long-term trend is very strong. If it falls lower, it might retest the psychological support at $50 again. Failure to hold the $50 floor, however, may trigger a deeper pullback toward the mid-$40s where stronger buying interest previously appeared.

The RSI is currently marginally above 70, meaning the metal is overbought. But in a strong market, the RSI can stay high for a long time as the market builds on itself.

The recently-hit all-time highs of $85.00 level is the next key area to watch. If it breaks, the price could jump to target the psychological $90-$100 range.

- Immediate support: $58.79

- Secondary support: $50.00 (psychological)

- Major resistance: $85.00 (all-time high)

- RSI: Trending strong without flashing overbought extremes

- MACD: Staying above the midline, maintaining bullish bias

Silver Market Outlook: Key Factors Traders Should Monitor Next

Silver is now sitting at a critical juncture. Year-to-date gains remain far ahead of gold, and industrial buyers continue to anchor the market during dips. If the metal can push through resistance and sustain momentum into December, the next leg could be substantial.

For traders, the focus is now on:

- Whether the $85 level breaks convincingly

- How inventory drawdowns evolve on major exchanges

- Shifts in solar and EV production forecasts

- US dollar and Treasury yield trends

Silver’s mix of tight supply, strong industrial use cases, and improving technical structure keeps the long-term outlook constructive. The next breakout will determine whether this rally extends into new territory or pauses for consolidation.

I predicted this in my last Silver price forecast. I also regularly update the price targets on my Twitter, where you are welcome to follow me..

Silver Price Prediction 2030

A lot can happen in the world till 2030. Considering the current state of the global economy and the inflation worldwide, I’d be surprised if Silver doesn’t make a new all-time high within the next seven years. Therefore, XAG/USD may break above its 2011 all-time high of $50. However, close attention must still be given to the changing global macroeconomic scenario.

Silver Price Prediction 2040

While the Silver price prediction for 2040 is anybody’s guess, we can still consider a few different scenarios. If the US dollar remains the global reserve currency within the next two decades, Silver can comfortably trade above $150 by 2040.

Where To Buy Silver?

You can buy silver on brokers like ATFX, IG, TD Ameritrade, Interactive Brokers, Capital.com, Exness, etc. These brokers allow you to trade the XAG/USD pair by adding minimal margin. However, you must learn risk management before taking leveraged positions on any asset.

How To Trade Silver?

Nowadays, there are various ways to gain exposure to the volatility in precious metals. Holding silver physically involves additional costs. Therefore, investing in Silver CFDs or futures contracts is best via an online broker like eToro, Exness, TD Ameritrade, etc.

What is The Spot Price Of Silver?

As the name suggests, the Silver spot price is the price of bullion coins for immediate delivery. The current spot price is $30.83, but it is very volatile as it trades almost 24 hours a day worldwide wherever the markets are open. The biggest trading volume comes from the US, UK, Japan, Hong Kong, etc.

Silver Price Outlook: Final Takeaway for Traders

Silver has delivered a striking rebound in early 2025 after last year’s sharp pullback, driven by a resurgence in industrial demand and a renewed bid for safe-haven assets. XAG/USD has pushed above $80, and the bulls will likely be targeting $90 resistance zone next. A clean break above this band would bring the milestone $100 mark within reach, potentially signaling the start of another medium-term leg higher.

In my view, the market still feels underpriced relative to the structural supply deficit, but the next move will hinge heavily on macro conditions, especially the Federal Reserve’s policy tone and how inflation evolves through the first half of the year.

Silver reaching $100 is possible long term, but it would require sustained supply deficits, stronger industrial demand, and a major shift in global monetary conditions.

Silver has solid 5-year potential due to structural industrial demand, tightening supply, and its role as a hedge during economic uncertainty.

Most forecasts expect silver prices to trend higher as renewable energy growth, electronics demand, and supply shortages continue to support the market.