- Park Medi World IPO was massively oversubscribed, but investor reaction in the stock market has been muted

- The company's fundamentals remain strong, and a wide network of hospitals in Northern India offers strong revenue base

- The company reported a 40% jump in net profit in fiscal 2025

Park Medi World’s stock market debut has been quite the ride. When it started trading on Wednesday, December 17, 2025, its shares opened on the Bombay Stock Exchange (BSE) at ₹155.60, which is almost 4% lower than the initial price of ₹162. Many were surprised by this, especially given that the IPO had been oversubscribed about 8.5 times.

The non-institutional category showed particularly strong interest, with subscriptions reaching 16 times the offered amount, according to reports from The Economic Times and official exchange data.

Why the Slow Start?

You might wonder why a stock that seemed so popular in the primary market stumbled the moment it hit the exchanges. One clear signal was the Grey Market Premium (GMP), an informal indicator of pre-listing sentiment. Market watchers like Chittorgarh and India Today pointed out that the GMP had dropped from a high of 13% to around 3-4% just before the listing. This decrease suggested that investor enthusiasm had cooled off, possibly because there were other major IPOs happening at the same time, like ICICI Prudential AMC.

Oversubscription often happens because of short-term speculation. Regular investors often apply in large numbers hoping to get shares and make quick profits, treating IPOs almost like a lottery. Meanwhile, wealthy individuals use borrowed money to bid aggressively, aiming for similar short-term gains. In Park Medi World’s case, the non-institutional category was the main driver of this surge in subscription.

Will Park Medi World Stock Rebound?

Park Medi World remains fundamentally positioned in a growing sector The company has a solid position in a growing industry. With 14 hospitals accredited by NABH, primarily in North India, it stands to gain from the increasing need for affordable healthcare, driven by changing demographics and government initiatives. The company intends to use the money raised from the IPO for paying off debt (₹380 crore), building new hospitals, buying equipment, and possibly making acquisitions.

Looking at the company’s fundamentals, there’s reason for optimism. Park Medi World reported a 40% increase in net profit for the fiscal year 2025, and a significant portion of the ₹770 crore raised from the new issue will go towards debt repayment. According to analysts at Swastika Investmart, the company could save around ₹15 crore in annual interest costs, which should strengthen its financial performance.

History shows that high-quality stocks with poor debuts often see a “value-buying” rebound once the initial volatility settles. We saw a hint of this on the listing day itself, when the stock recovered from its low point to reach an intraday high of ₹165.75. Most experts anticipate that a steady recovery could take about 3 to 6 months as institutional investors establish their positions based on the long-term demand for healthcare services.

Park Medi World Stock Forecast

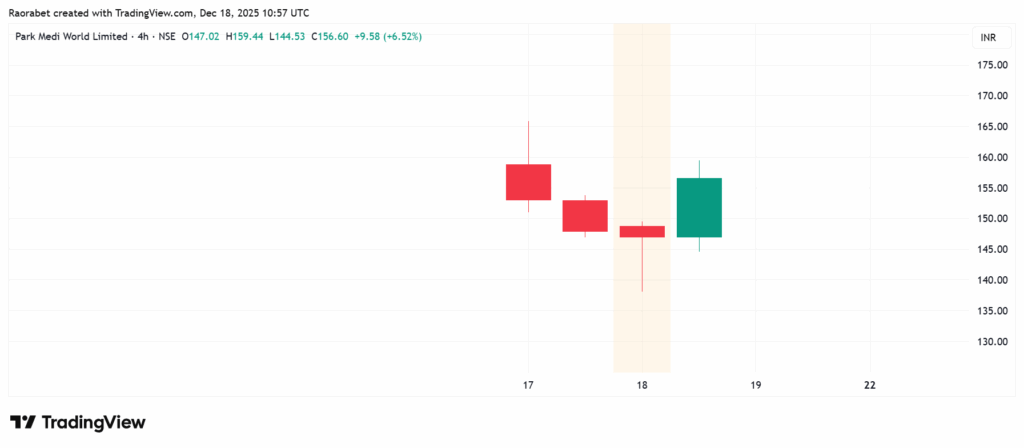

The Relative Strength Index (RSI) is hovering near the 35-40 mark, suggesting the stock is approaching “oversold” territory but hasn’t quite hit a floor yet. Immediate technical support is visible at ₹145, a level echoed by analysts as a critical stop-loss zone. On the flip side, the IPO price of ₹162 now acts as a psychological resistance. The stock needs to sustain a close above ₹165 on high volume to confirm a trend reversal and attract fresh bullish interest.

Park Medi World 4H chart on December 18, 2025. Source: TradingView

The high oversubscription was overshadowed by a falling Grey Market Premium (GMP) and aggressive pricing at ₹162. This left no room for listing gains, causing short-term traders to sell immediately upon the tepid opening.

Debt reduction and expansions from IPO proceeds, plus healthcare growth, could drive recovery in 6-12 months if execution strengthens, based on company plans and sector outlook.

Strong bids from non-institutional and institutional investors, reflected speculative interest in quick gains despite modest grey market signals.