- A spike in US Treasury yields last week was a sign of underlying trouble and trade tariff threats have exacerbated the situation

- Negotiations over US acquisition of Greenland could drag for months, with the impact of tariffs biting in the intervening period

- US stock markets are closed today, January 19, 2026 for a national holiday, Martin Luther King Jr. Day

U.S. markets are closed today for Martin Luther King Jr. Day, on a day when top financial markets are feeling the pinch. Stock futures point to declines, a sign of the worries that have been building over the past week. The FTSE 100 was down by 0.7%, Japan’s was at -0.6% while Germany’s DAX 40 was down by 1.2% at the time of writing. What’s behind this? Is it just a temporary setback, or something bigger? We look at the key factors, based on the latest reports and analysis.

Tariff Risk Returns with Greenland at the Eye of the Storm

The primary catalyst appears to be escalating geopolitical tensions stemming from President Trump’s recent statements. He has threatened tariffs on eight European countries, including Germany, the UK, France, Denmark, Norway, Sweden, the Netherlands, and Finland, to pressure them into facilitating a U.S. acquisition of Greenland.

These tariffs, potentially starting at 10% in February and rising to 25% by June, have already caused U.S. stock futures to drop and European markets to open lower. The European Union is considering up to €93 billion in retaliatory tariffs, fueling fears of another trade war, according to the Financial Times.

Is a Deeper Market Drop Waiting?

The question now is whether the market will fall further before it recovers. Last week ended with slight losses for the S&P 500 and Nasdaq, partly due to rising Treasury yields that reached a four-month high of 4.23% on January 16.

Meanwhile, recent reports say investors are nervous about who will head the Fed when Jerome Powell’s term ends in May. President Trump’s comments on the Federal Reserve, including his change of heart about nominating Kevin Hassett as chair, have added to the uncertainty.

Global economic news isn’t helping either. China’s fourth-quarter GDP growth slowed to 4.5%, the weakest in almost three years, suggesting weaker spending and more caution. All these things suggest a bigger market correction is possible. The Buffett Indicator, which compares total market value to GDP, is at an alarming 222%, way above the 200% mark that came before the 2022 bear market.

January is often a bumpy month as investors’ predictions for the year meet the reality of fourth-quarter earnings. Vanguard’s 2026 Outlook suggests that, while the year should be mostly positive, returns will likely be lower for longer.

Many analysts expect this uneven, sideways-to-downward trend to continue through the first quarter as the market deals with the effects of the One Big Beautiful Bill Act and possible new trade tariffs. If the tariff disputes ease up quickly, the dip might be short, maybe over in weeks. However, a CNBC report suggests Trump’s tariffs aren’t likely to disappear soon, meaning negotiations could drag on and keep volatility high into the second quarter.

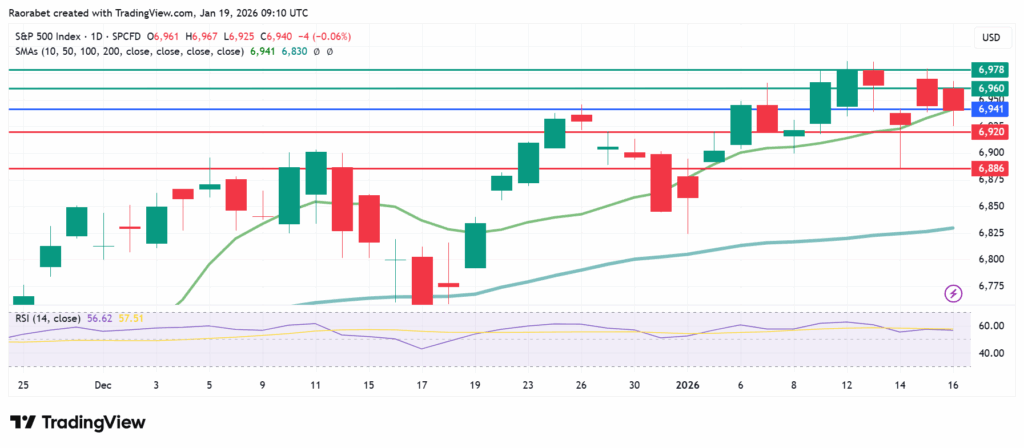

S&P 500 Technical Analysis

Looking at the S&P 500, it’s testing its main upward trendline. The index closed at 6,940 points on January 16, and will likely be under downward pressure unless it stays above the 10-day SMA, currently at 6,941. Breaking that level could send the S&P 500 Index higher to test 6,878.

There’s immediate support at 6,920, below which the upside narrative will be invalid. Also, an extended downward momentum could push the action to test 6,886 for the second support. If that level is breached, a deeper correction could send the action to the YTD lows/ 50-day SMA level of 6,886.

S&P 500 Index as of close of business on January 16, 2026 and support and resistance levels for January 19, 2026. Created on TradingView

The primary reason is President Trump’s tariff threats on eight European countries over Greenland, raising fears of a trade war. This has led to sinking futures and caution.

U.S. markets are closed for Martin Luther King Jr. Day. This includes the NYSE, Nasdaq, and the U.S. bond market. Trading will resume on Tuesday morning, January 20.

Keep an eye on fourth-quarter corporate earnings reports and the Federal Reserve’s next interest rate decision. Also, monitor the unemployment rate, as a weakening job market could indicate deeper economic problems.