- Rising oil prices, a slowdown in passenger traffic in Europe and North America and geopolitical tensions pose greatest risk to IAG performance in 2026

- The company will release its quarterly earnings report on February 27, and that could potentially trigger increased demand

- IAG stock value rose by 35% in 2025, driven by rising profit and share buyback

Observing the trajectory of International Consolidated Airlines Group (LSE: IAG) shares as of January 20, 2026, one notes the recent decline from a post-pandemic peak of 438p on January 7. This has resulted in a 0.8% year-to-date loss, prompting reflection on the underlying influences. So what’s pressuring the stock and how is it likely to perform in the coming weeks and months?

Why is IAG Share Price Declining?

The main source of pressure seems to be rising oil prices, fueled by global events. Even though Bernstein analysts still rate IAG highly, pointing to its strong position in the North Atlantic market, investors are worried about these rising tensions. Recent actions by the United States related to Venezuela and Iran have pushed oil prices up consistently.

Also, the weak performance in North American and European markets we saw in the third quarter of 2025, where passenger revenue per available seat kilometer fell by 7.1% and 6% respectively, is still having a negative impact on the sentiment.

Furthermore, International Air Transport Association (IATA) forecasts global passenger traffic will go up by 4.9% in 2026. Still, the airline industry doesn’t have huge profit margins, and IAG is dealing with a continuing problem of not having enough planes due to supply chain delays, which will likely take years to fix.

Is a Near-Term Rebound in Sight?

A rebound in the near term appears plausible if certain conditions align. IAG’s 2025 was a year defined by the 1 billion share buyback and surging profits. There is a strong case for a near-term rebound. The company is scheduled to release results on February 27, where many expect a fresh buyback announcement of up to €2 billion.

If oil prices level out or go down, that could also help the stock recover. Analysts are generally positive, with an average price target of 492.77p according to Yahoo Finance, suggesting there’s room for growth from the current price of around 410p. Upgrades from analysts like Morgan Stanley, giving IAG an Overweight rating, show confidence in its financial health and the ongoing demand for travel.

Still, there are risks. Economic downturn in important markets like the UK, Eurozone, and the US could reduce travel demand. While IAG’s finances are in good shape, the easy gains from the post-pandemic recovery are likely past. So, even with analysts predicting revenue growth, matching the 35% gain from 2025 seems unlikely for 2026.

IAG Share Price Prediction

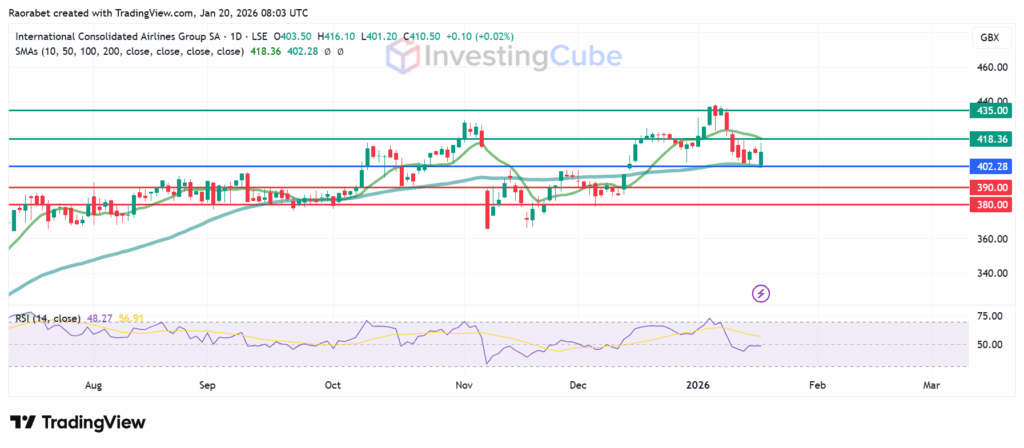

IAG share price is testing a key support level near the psychological 400p mark. The stock’s Relative Strength Index (RSI) is around 48, indicating it’s not overbought or oversold but is slightly negative in the short term. If the price falls below the 50-day SMA level at 402.28p, it might drop to around 390p, a level where it consolidated in late 2025. A stronger downward momentum could send the stock lower to test 380p. On the other hand, the upside outlook shows there’s primary resistance at the 10-day SMA of 418.36p, and the 435p level could be the second major barrier.

IAG share price daily chart with key support and resistance levels for January 20, 2026. Created on TradingView

The key sources of pressure include rising oil prices due to actions by the U.S. in Venezuela and Iran, combined with slow markets in North America and Europe.

The main risks are unstable oil prices, economic slowdowns, and global conflicts, which could affect demand and profits.

Many analysts think so. With a big earnings report and a possible multi-billion-euro buyback announcement coming on February 27, the stock has a good chance to reverse its current decline.